Illumina MiSeq i100 announcement

Illumina held an online event “Something big is coming. And it’s small”. The MiSeq i100 series, a slightly smaller in footprint than the NextSeq 2000, very similar in shape to a shrunk down NovaSeqX.

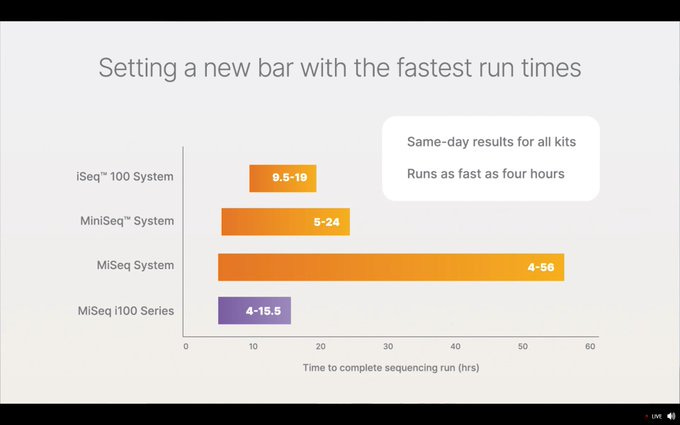

The instrument has faster cycle times, with Same-day results at the quality levels that Illumina has been operating for the last 2 decades.

Same-day results is probably the most differentiating characteristic of the instrument. In a slide comparison later on, it shows the difference of this revamped MiSeq instrument compared to the original MiSeq run times.

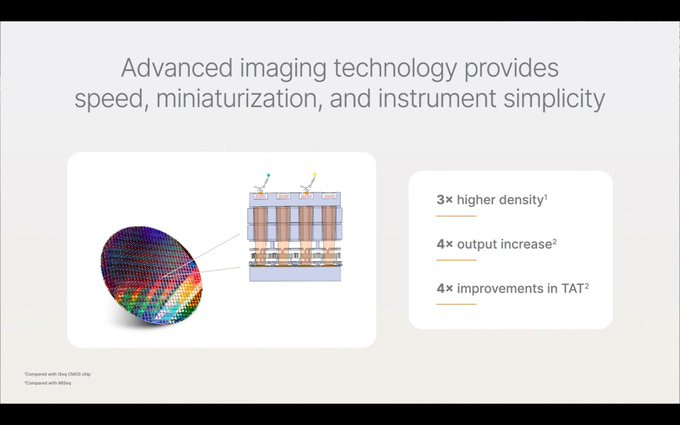

As the MiSeq i100 name indicates, this instrument is a blend of the MiSeq capabilities, aiming at the low-throughput applications, with the iSeq 100 technologies, namely the CMOS imaging and integrated imaging and microfluidics cartridge.

The footprint of the instrument, narrower 40x45cm than the old MiSeq (68x56cm), slightly taller with the screen upright.

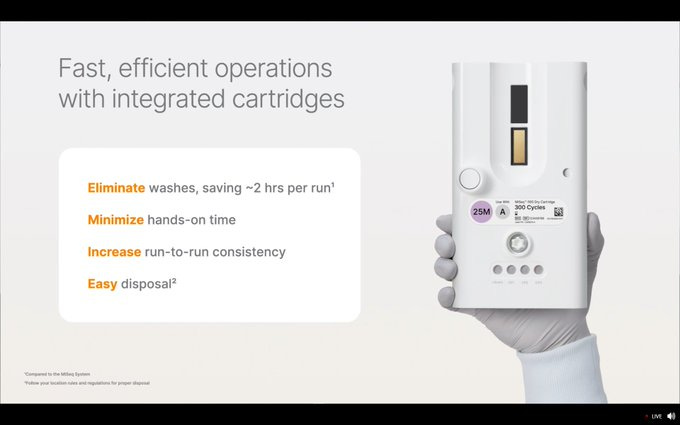

As it was already alluded to before the presentation, looking at the pictures of the patents that Illumina has recently got granted, there’s been a lot of work on the cartridge system, here a 25M 300 cycle cartridge shown with the CMOS part at the center top.

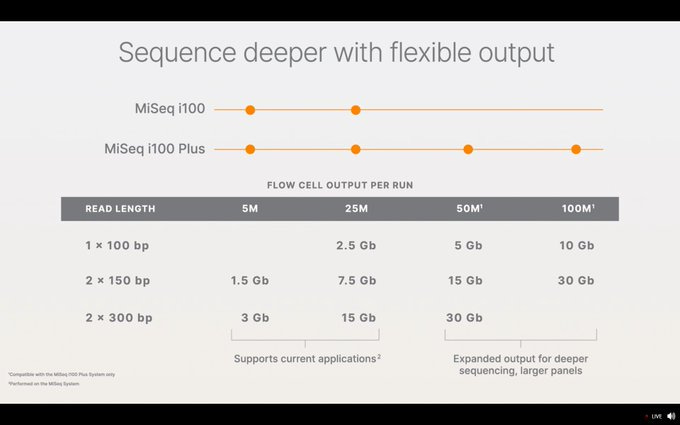

Probably one of the most important slides, the throughput of the different cartridges available, with a maximum of 30Gb of data, either as 50M reads x 600 cycles or 100M reads x 300 cycles.

Illumina is continuing the same model of segmenting each instrument into a couple of options: a lower throughput less capable one with presumably a lower cost, and here the “Plus” version with more cartridge options, higher throughput, presumably with a higher cost. Unclear if the difference between the two is going to be in the physical components, as is the case in the NextSeq2000 vs NextSeq1000 or the NovaSeqX Plus vs NovaSeqX, or if it will be the same physical device with the extra features locked by a firmware update.

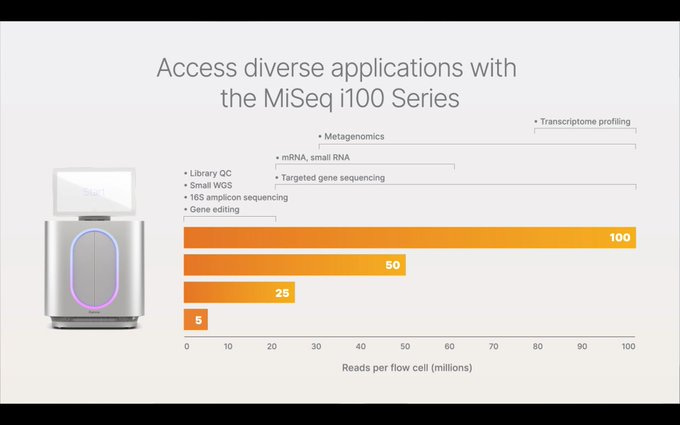

This new instrument is a revamping of the low-throughput line of products, which was slightly disjointed with a very old original MiSeq, a MiniSeq with a lot of overlap with the original MiSeq, and an iSeq 100 that got mostly traction as a sample QC device.

The new MiSeq i100 simplifies the product line into 3 main instruments, and it is now most probably time to say goodbye to both the original MiSeq and the MiniSeq, maybe even the iSeq 100. There were no exact details on the phasing out of these instruments, but Illumina hasn’t been shy in phasing instruments out with aggressive timelines before.

Probably the second most informative slide of the presentation, the run times comparison. This shows how old the original MiSeq looks in comparison to more recent instrument, with the longest runtime taking 56 hours and requiring washes that can take up to 2 extra hours.

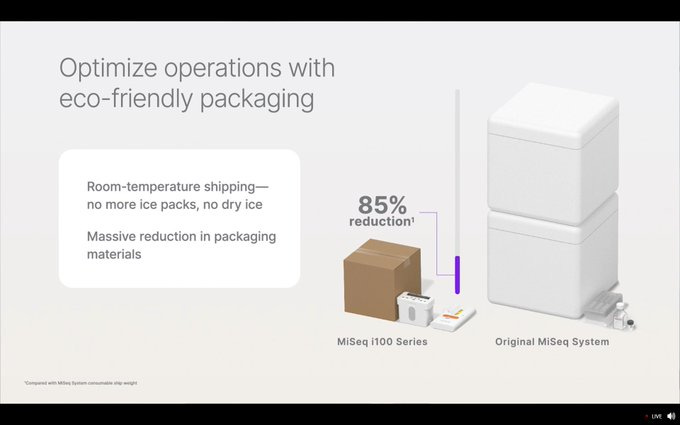

The packaging has been simplified, following the trend we saw with the NovaSeqX, and this means that Illumina is now not reliant on sourcing large amounts of dry ice in the San Diego port which did become a bottleneck for a period of time in the past.

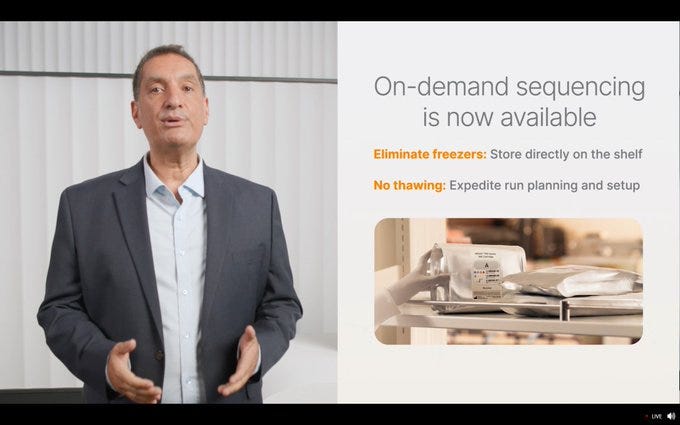

The trend started with NovaSeqX is continuing here with the room temperature reagents, which simplify the life of lab managers trying to cram lots of large boxes into freezers and having to plan the thawing of reagents before a run started.

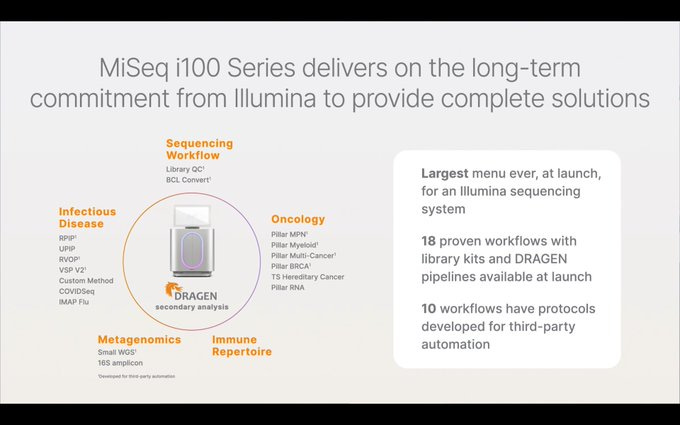

Illumina continues to pursue the sample-to-answer narrative since they acquired Edico and their DRAGEN software platform about a decade ago. The MiSeq i100 series, aimed at potential customers that may not have a dedicated team of Data Scientists helping with Data Analysis is the perfect opportunity for them to demonstrate if the DRAGEN platform has matured to the level that customers expect when it comes to sample-to-answer products.

As part of the tech developments that went into this new machine, the advanced imaging is now supported by a CMOS with denser, higher throughput imaging features.

This is all integrated into a single cartridge with the CMOS flow cell on top, and the microfluidics directly integrated into it. There weren’t any details about the Improved sustainability, as it seems from the outside that Illumina has gravitated towards integrated cartridges with more and more plastic in them. It is important that Illumina continues to show how these can easily be disassembled and the components recycled if the company wants to be able to claim that the sustainability of their cartridges is improving, rather than getting worse.

The dry component shipping is done with a novel microsphere manufacturing process, which is reducing packaging by up to 85% compared to previous iterations of the reagents.

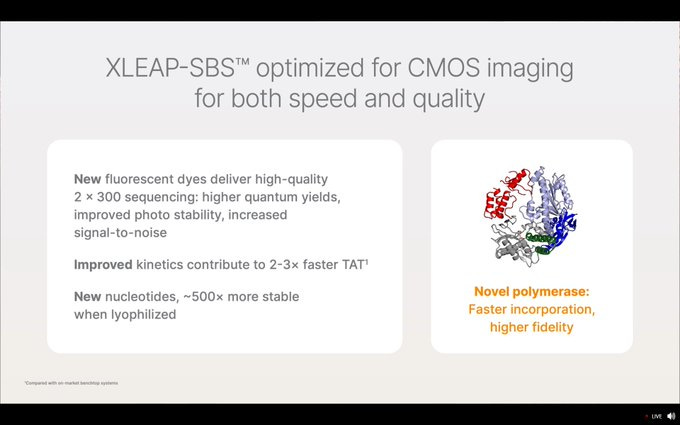

Finally, some details about the biotech components of the reagents: the enzymes and the functional nucleotides that are part of the SBS method invented by Solexa in Cambridge, UK about two decades ago. This instrument runs an optimised version of the XLEAP-SBS technology that was unveiled in the NextSeq 2000 refresh. Lots of work with the polymerase, and new nucleotides, more stable when lyophilized.

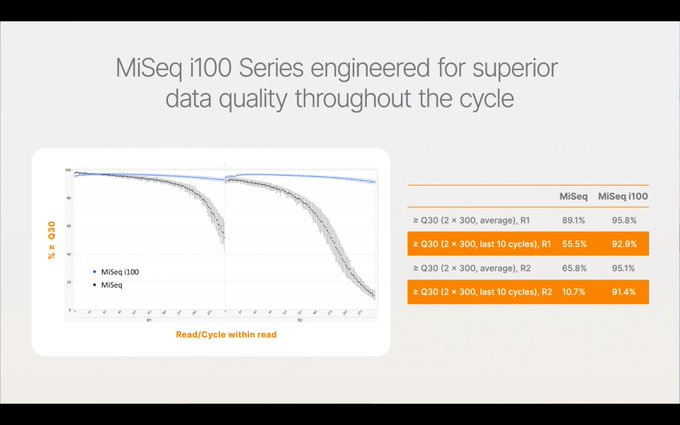

Another important metric is the Q-score plots over the read 1 and read 2 cycles. These are clearly better at the end of the read compared to the old MiSeq system, with higher percentage of based above Q30. The 2x300 cycle run was one of the only reasons that people would keep their old MiSeq instrument in the lab, and now there is an equivalent in the new MiSeq i100 series.

The DRAGEN workflows are part of the sample-to-answer play for this instrument series. The announcement here is for the first 18 workflows incorporated into the box at launch, with 10 workflows compatible with third-party automation.

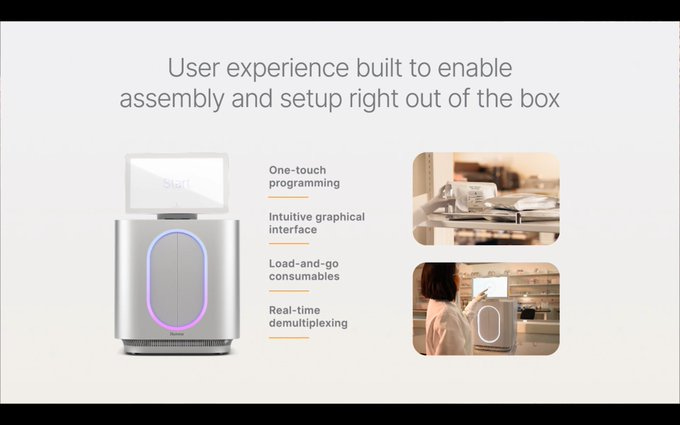

Many people may have forgotten that the iSeq 100 instrument was the first one that didn’t need a specialist to fly over and unbox it for the customer. The same is now true for the MiSeq i100 series, which can be unboxed and setup by the customer without intervention of any Illumina field engineer.

No details given about the procedure that needs to take place if the instrument malfunctions, but presumably the customer would unplug it, put it back in the box and ship it to Illumina for a replacement. Many commonalities here with the way people buy and use mobile phones, and the Illumina product line has a lot of similarities with Apple’s product line in the naming and the segmenting strategies.