10X Genomics JPM24 presentation

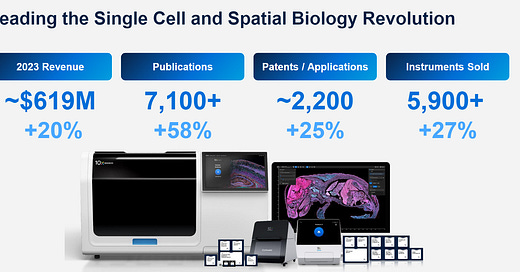

Initial slide with company profile by numbers, both on the revenue side but also how much people get out of these technologies (Patents / Applications)

In terms of revenue, $619M for the full of 2023, which as a comparison, is roughly where Illumina was when I worked for them, about 10 years ago.

As we will describe below, 10X Genomics prioritised the Xenium in 2023 over the Visium line, which means that 2023 has been the first year of the Xenium as a commercial product. They now have 250 instruments installed worldwide.

Lots of science already done with the Xenium, people posting about their instrument in social media

Not wanting to get tangled up in spec numbers, I will just state what 10X Genomics states: that they are between 3-14x more sensitive than MERSCOPE, 3-5x more specific than MERSCOPE, 2-15x more sensitive than CosMx, 20-45x more specific than CosMx, and 3-4x Faster than CosMx. These are the type of numbers that Illumina had when the HiseqX and NovaSeq instruments where unmatched by the competition.

Lots of science done with the Xenium, and the fact that pre-publication is now the norm rather than the exception, it means we can list what science came out of the Xenium only after months of the experiments being done, rather than years.

Switching gears, a slide about what 10X Genomics is all about: cells!

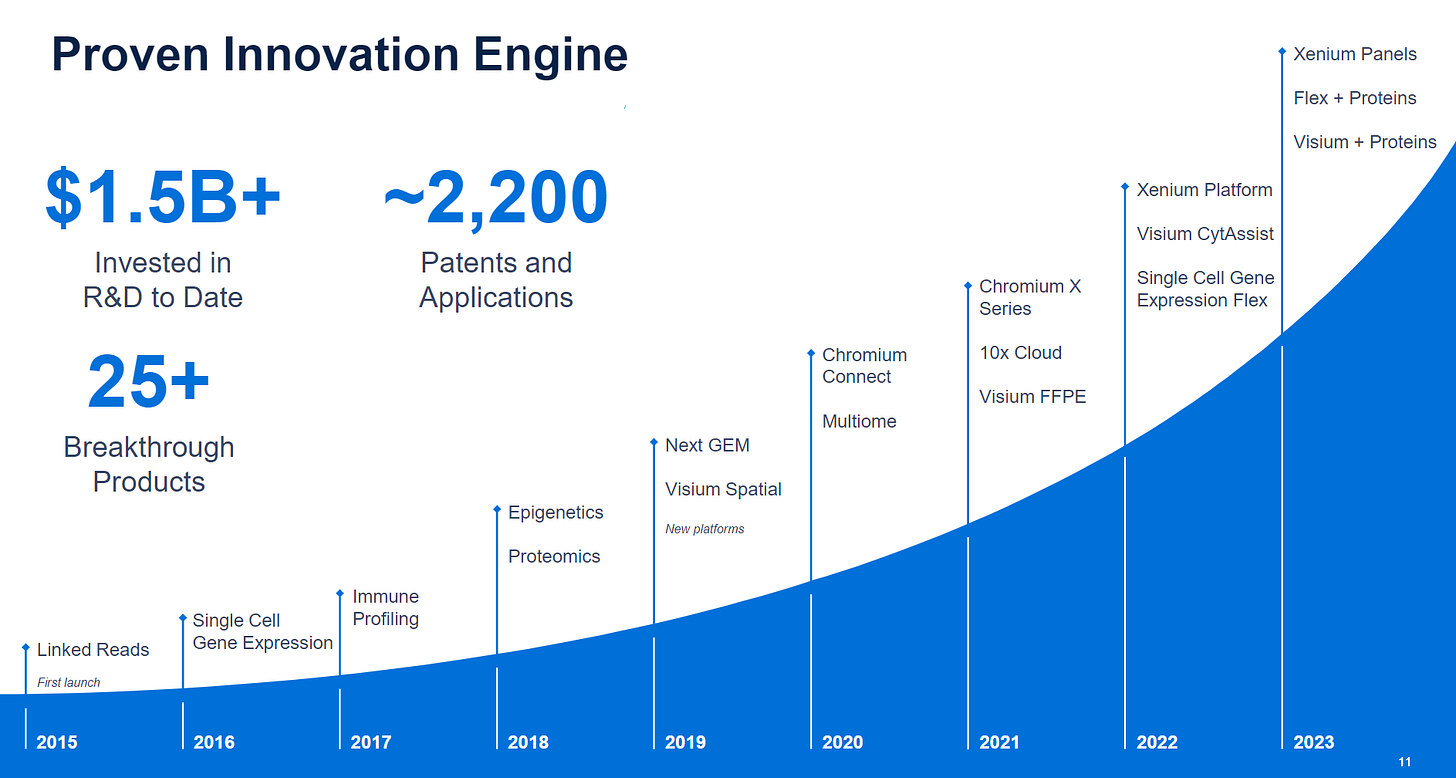

Slide with the trio of platforms, all involving doing something to RNA/DNA or protein molecules, but only 2 of the 3 have an NGS read-out

The Chromium line strong, with 5,150 instruments installed.

Now Visium is not instrument-free, so the Visium equivalent to the Chromium instrument is called CytAssist.

And the Xenium completes the trio of instruments

The Xenium roadmap looks promising, with a ~5000 Plex Panel (5 day run) expected to land in Q2 2024.

They announced they’ve already shipped 500 CytAssist instrument, which prepares the ground for Visium HD apart from Xenium.

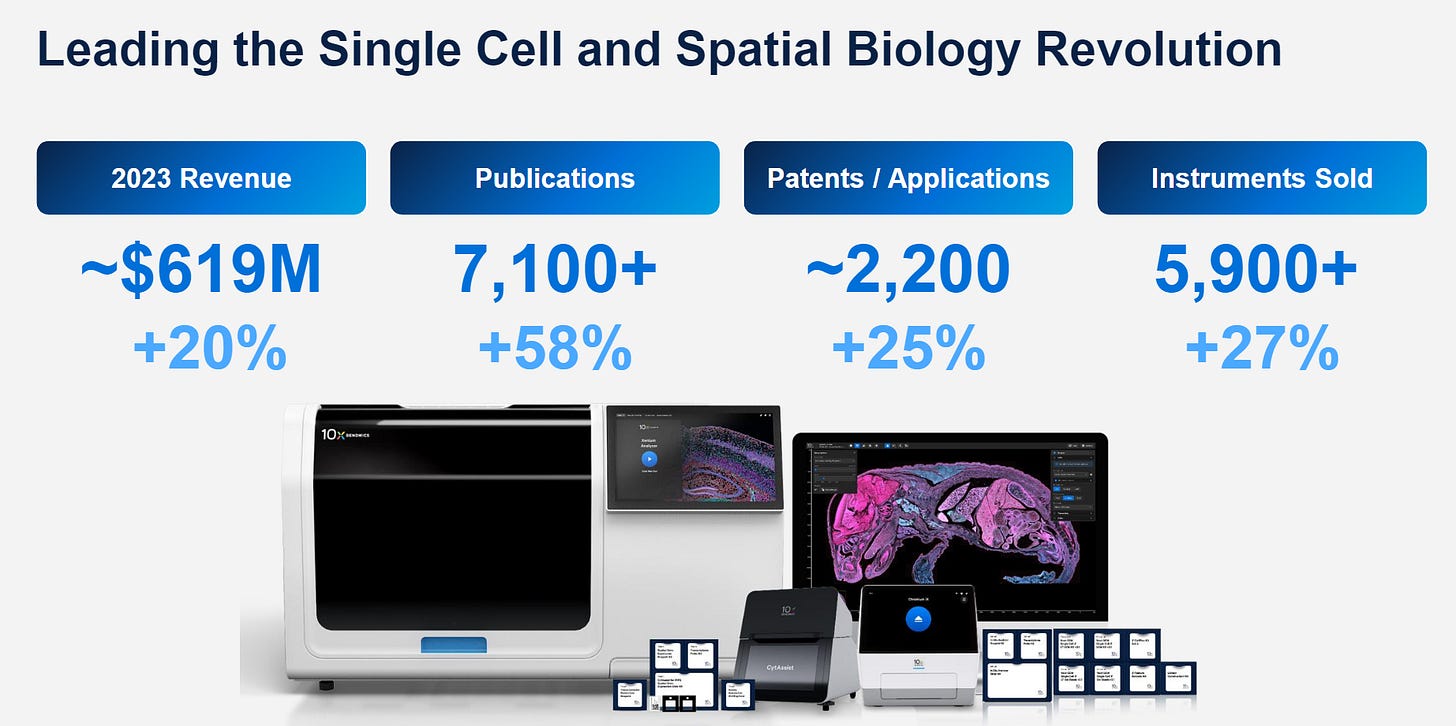

Visium HD: 2 micron squares, much denser than the Visium v1.

One can visually see the difference

Already tested on a broad range of samples.

Visium HD is shipping this quarter, for people who already have a CytAssist, they only need to preorder the slides and associated kits.

One slide that captures what 10X Genomics strategy is here: to continue knocking down old legacy technologies with higher resolution and higher throughput/plexy technologies. Examples are PCR/qPCR, where single-cell transcriptomics is now enabling 1000s of transcripts per cell, which is a step up in cellular resolution from Bulk next-gen sequencing. Another sector is IHC and IF & ISH, which now with the Xenium can be done at high plexy for large panels. ELISAs are put at mid-plexy but low spatial or cellular resolution: some will disagree with this, but 10X Genomics wants to replace this and other technologies with their trio of products.

The third leg of the 10X Genomics stool, Visium HD, now completes the trio of product lines where it’s difficult to argue that the competitor products would be better. 10X Genomics emphasizes the product complementarity, which if aided by software integration, it allows researchers to seamlessly observe comparable data points on all 3 platforms for a given sample.

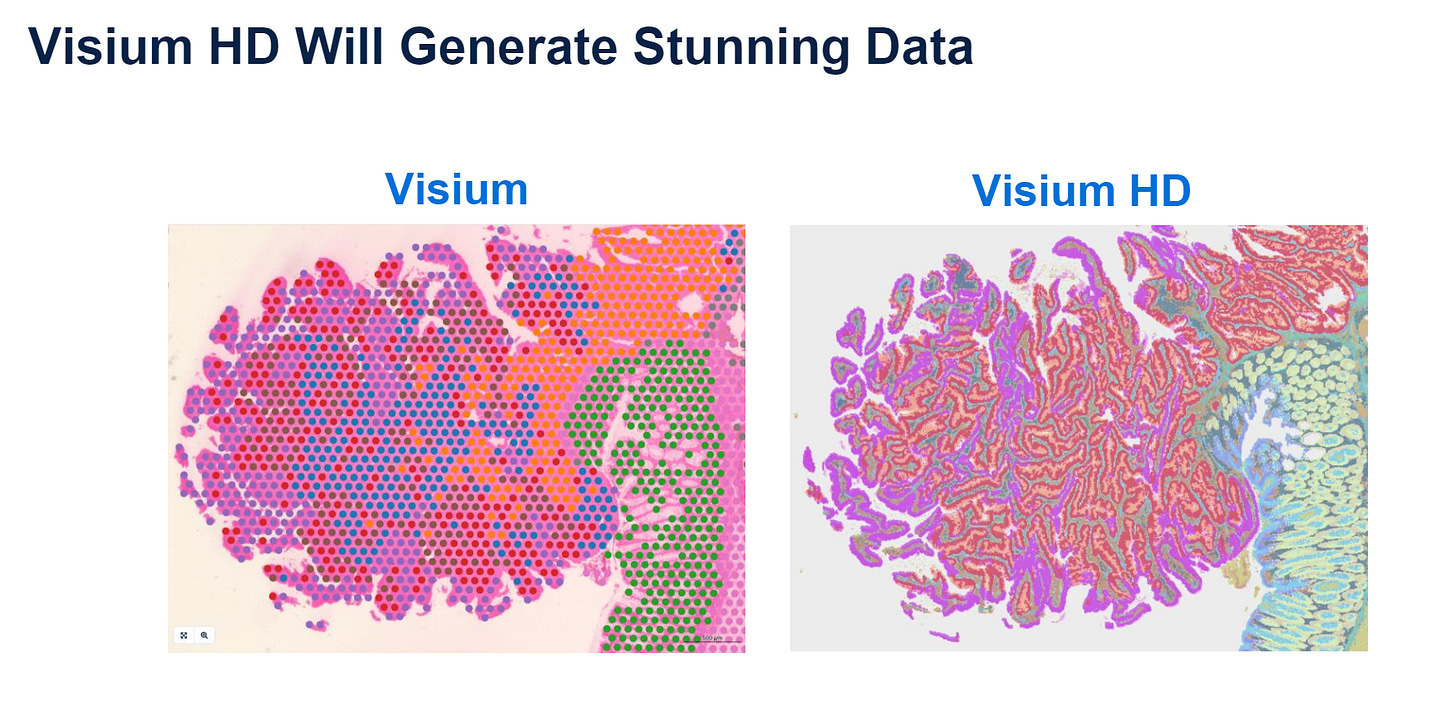

The history of the company. Biggest gear up was the Xenium line, but important to note the diverse array of kits that Chromium has accumulated now. This is one of the differentiators to other single-cell Chromium competitors: many start with bog-standard GEX, but don’t have sample prep accessory kits or other omic modes.

In the second half of the post, I’ll describe the competitive positioning of 10X Genomics products and my predictions to where things can go from here.

Now that the Xenium and Visium CytAssist have been released, the Chromium is the elder of the family. But 10X Genomics has plans to revamp this product line, to go into the $100/sample realm. At the moment, everything is more like $1000 away per experiment, or $500-600 with the reformatted LT line (low throughput), compatible with the Chromium X. So a $100/sample product would lower the barrier to entry, and also allow a lot more operational flexibility for QCing of samples.