Here are my highlights of the presentation that Illumina gave at JP Morgan in 2024.

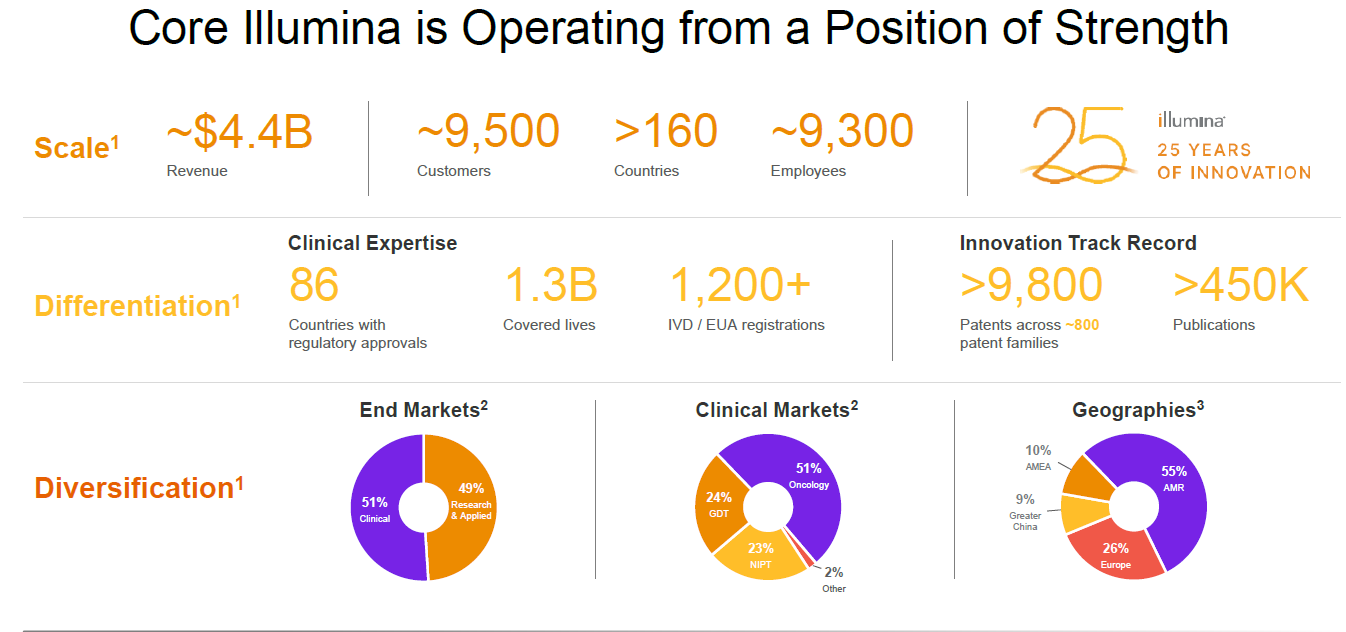

As an intro, Illumina is a Life Science Tools company that sells Next-Generation Sequencing (NGS) instruments and reagents. Although the company peaked at a $70B valuation a couple of years ago, it is now a $22B company with 9,000 people workforce that is struggling with growth as of late. They still make more than $1B revenue per quarter, as stated in the presentation:

“So in '23, core Illumina delivered more than $4.4 billion in revenue and continue with strong positive cash flows. As I've shared with you, Illumina's core business is really compelling to me. In fact, this is why I'm here, and I'm confident that we're very well positioned to grow.”

They defined the FQ4 2023 results as Exceeding expectations, but at the same time they’ve been tempering expectations for several quarters now.

The Estimize Revenue Wall St Consensus was 1,073 for FQ4 2023 and it is currently below that number for FQ1’24, only starting to grow in the next two quaters after that.

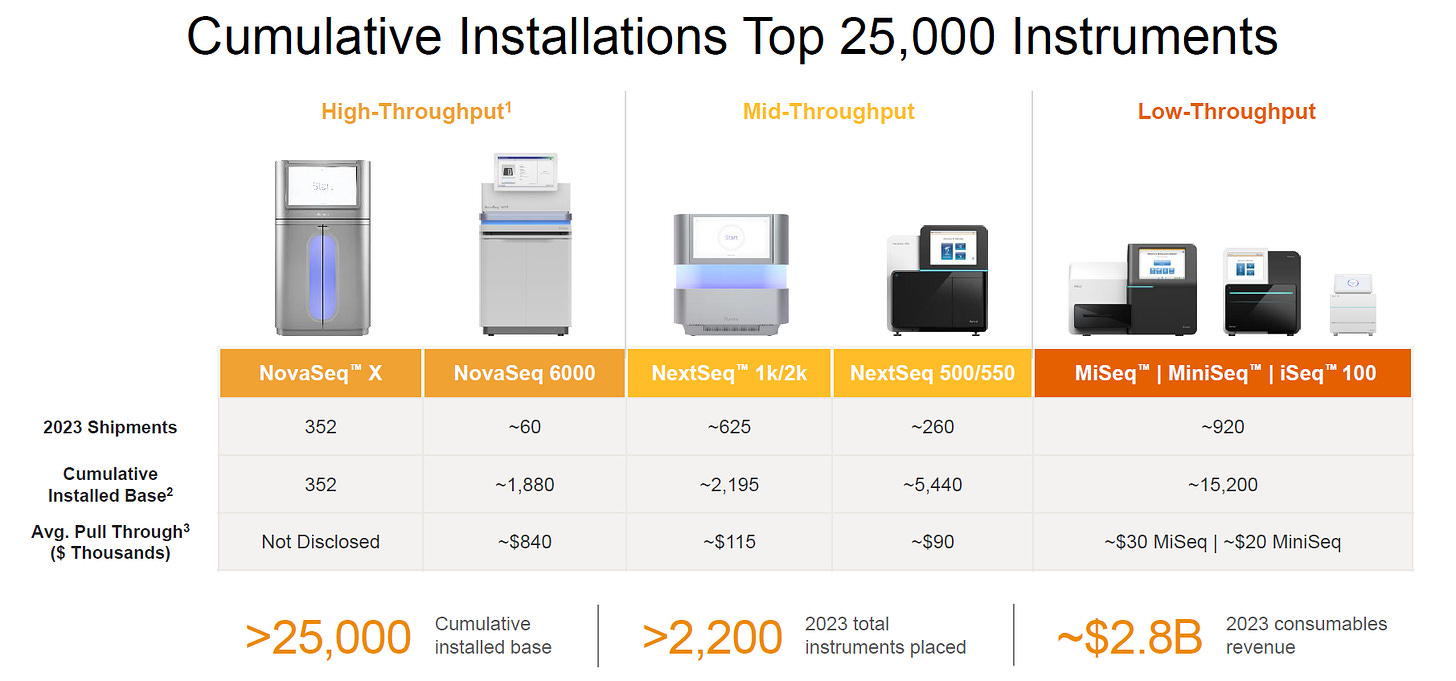

They have now shipped 352 NovaSeqX instruments, a few above expectations, and with 38 on backlog. New countries and 35% for clinical also highlights.

This next slide is the updated install-base numbers. You can compare the numbers to other technologies at http://bit.ly/ngsspecs

The 4 steps of Illumina’s NGS workflow: Prepare / Sequence / Analyze / Interpret. I think it’s fair to say that they’ve succeeded in the first 2, but it’s debatable if they have succeeded in the 3rd and 4th steps.

The 25B NovaSeqX flowcell is now the highest single instrument NGS sequencing throughput available, without counting MGI Tech DNBSEQ T20x2, which is more like 2 instruments taking an entire room.

The next slide is the most difficult task for the new leadership team at Illumina: how to deal with the fact that Revenue and Ops margins seem to look flat for 2024 as they did in 2023.

The strategic priorities for 2024 are to drive the Top Line, continue to improve operations and solve the big problem they have with GRAIL.

If the NovaSeq 6000 customers transition to NovaSeqX, the company still has a good ramp up ahead. At the moment they are at 10% for single Nova6000 customers and 40% for multi-Nova6000 customers.

The narrative for NovaSeqX is easy to explain: “More!”

Some operational updates to give people hope that the bottom line will get better, e.g. consolidating the San Diego campus, rationalizing third-party vendor spend, reducing COGS, etc.

The GRAIL situation points in the right direction, i.e. divesture and not pissing off the SEC/FTC any longer.

The new leadership has a difficult task ahead.

In the next few lines, I’ll give my impression on the presentation and how I think Illumina’s strategy could evolve in the next few weeks/months.