Illumina NovaSeq product line elasticity

How much we can stretch the NovaSeq rubber band?

Headline

There are signs in Illumina’s customer base that the elasticity of the NovaSeq product line may be reaching its limit. Up until now, every time the CEO or CFO of Illumina would jump on a quarterly call, they would emphasize how elastic the market is to the new products and kits that Illumina releases. We may be reaching a point now where this is no longer true: customers may not like the batch number of samples that they need to put into a NovaSeqX run, in terms of their operating flexibility, compared to what they are used to in the NovaSeq 6000. If the market and customers are showing signs of resistance or reduced flexibility in adapting to the new sample requirements associated with the NovaSeqX instrument, this could have implications for Illumina's business and the perceived value of the updated product.

Elasticity explained

In economics and business, the elasticity of a product refers to its responsiveness or sensitivity to changes in certain factors, such as price, demand, or supply. It measures how much the quantity demanded or supplied of a product changes in response to a change in the relevant factor.

In the context of a lab instrument, such as one that processes samples, the elasticity can be associated with the instrument's processing capacity or throughput. Specifically, the elasticity of the instrument's processing capacity refers to how the instrument's ability to handle samples (measured in samples per day) changes in response to changes in its design or capabilities.

In a given example, if the current version of the lab instrument can process 1000 samples per day and the next version is capable of processing 2000 samples per day, it indicates an increase in the instrument's processing capacity. The elasticity of the instrument's processing capacity, in the eyes of the customer, would be considered positive or elastic, the change in instrument's throughput is adequate to the customer’s needs.

Having an instrument with a higher processing capacity can offer several advantages, including increased efficiency, reduced processing time, and the ability to handle larger volumes of samples. Researchers or lab operators can process a greater number of samples within a given timeframe, potentially improving productivity and throughput.

It's worth noting that the concept of elasticity can also be applied to other factors related to the instrument, such as price elasticity (how the demand for the instrument changes in response to a change in price) or supply elasticity (how the supply of the instrument changes in response to changes in factors like price or demand).

NovaSeq6000 vs NovaSeqX

The sample processing needs of the NovaSeqX may not be aligning well with customers' existing workflows or expectations. This could result in decreased operating flexibility, making it harder for customers to efficiently utilize the NovaSeqX instrument compared to its predecessor, the NovaSeq 6000.

The values below show the current configuration of the S4 flowcell runs for NovaSeq6000, in its maximum configuration, compared to the 10B flowcell configuration of the NovaSeqX, and then the last value is the 25B flowcell configuration, which will only become available in H2 2023.

Given each type of flowcell, there is only 3 sizes, and the possibility of running one or two flowcells concurrently:

If we compare this to the NovaSeq6000, there is a lot more choice, which is something that Illumina added over time, responding to customer’s requests and perceived demand. For example, the SP flowcells only became available years after the first set of flowcells were released together with the instrument.

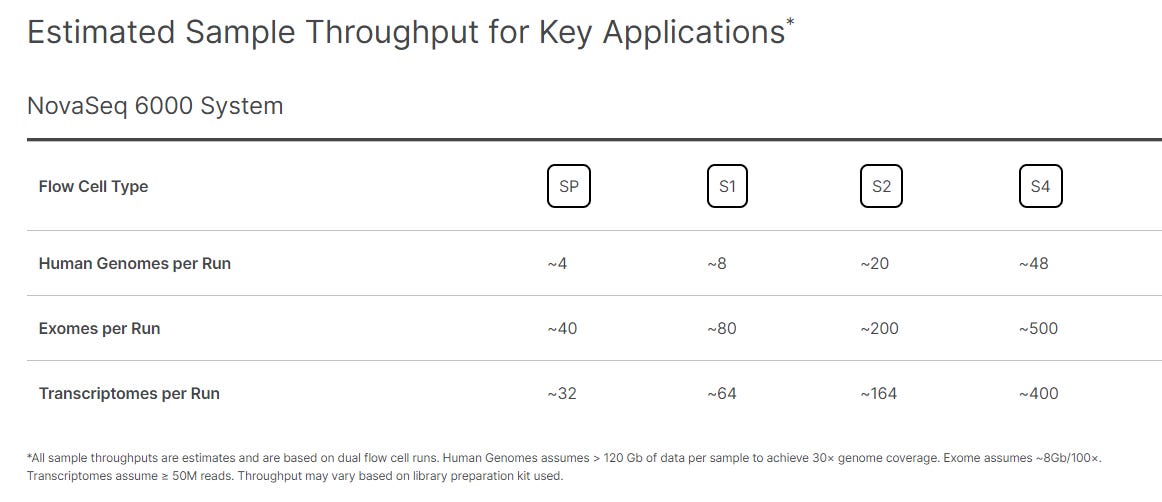

We can convert these to the estimated sample throughput for key applications, e.g. for the NovaSeq 6000, we have the number of samples for either WGS, WES or transcriptomes, with a nice 2x or 2.5x cadence in throughput from one flowcell to the next:

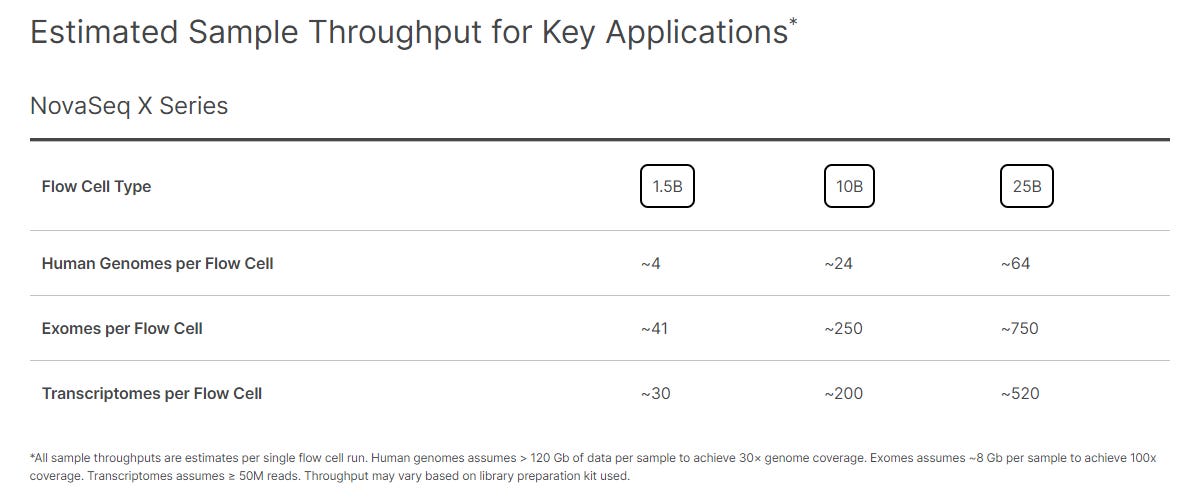

This shows more flexibility than the equivalent for NovaSeqX, where there is a big jump between the 1.5B flowcell and the 10B flowcell, with a large 6-7x difference between the two flowcells available today:

Behind the curtain, I explain what ILMN 0.00%↑ Illumina may be expecting from existing customers and what this may mean for pricing in the next year or two, compared to Element Bio and MGI Tech in the short-read NGS market landscape…