Thermo Fisher's recent acquisition of Next-Generation Proteomics (NGPS) company Olink is a significant move in the biotech industry. This acquisition signals a potential shift in Thermo Fisher's strategy to strengthen its position in the field of proteomics. However, it also highlights the company's reliance on other Next-Generation Sequencing (NGS) companies, particularly Illumina, to handle the read-out of Olink proteomics experiments.

The acquisition of Olink allows Thermo Fisher to tap into the rapidly growing field of proteomics, which focuses on the study of proteins and their functions. Olink is known for its innovative technologies in this domain, making it a valuable addition to Thermo Fisher's portfolio. With this acquisition, Thermo Fisher has gained a foothold in proteomics, a field with substantial potential for scientific and medical advancements.

Many NGPS products rely on a NGS read-out

It's important to note that Olink's proteomics experiments heavily rely on NGS technologies, and Illumina has been a prominent player in this space. Illumina's sequencing platforms are considered the "de facto" standard for many applications, including those related to proteomics. This means that, even after acquiring Olink, Thermo Fisher is dependent on other companies, such as Illumina, for certain critical aspects of their proteomics workflows.

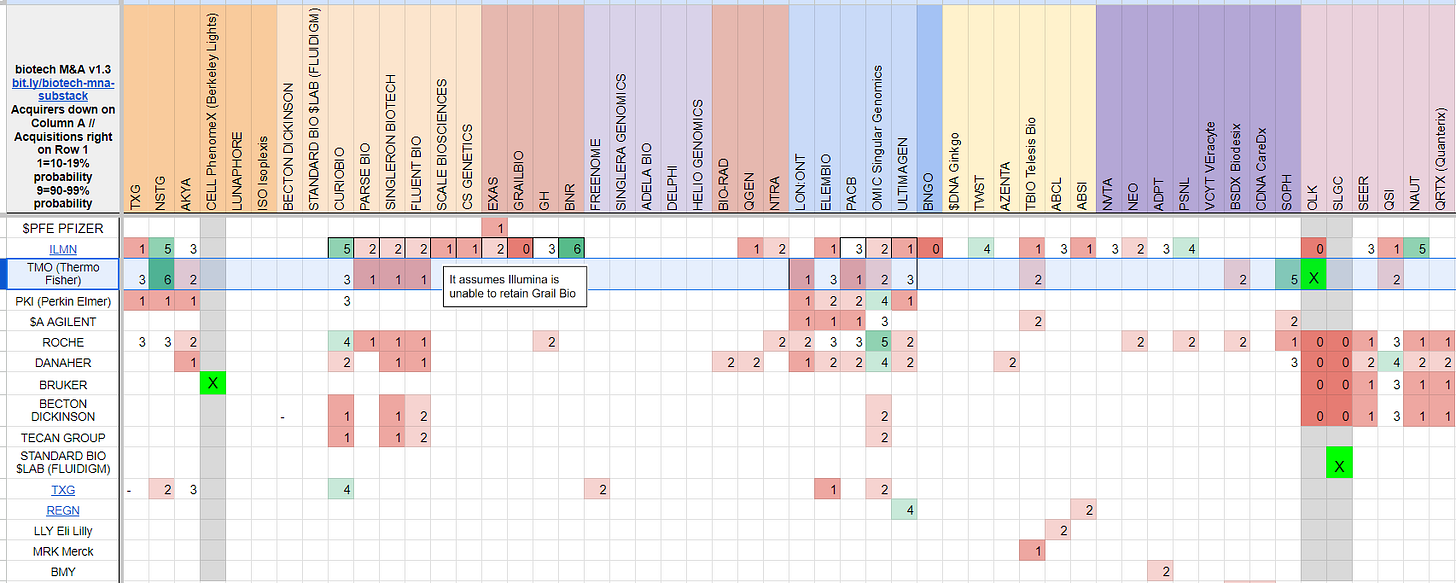

In the long-form post below, I discuss what it would mean for Thermo to acquire their own short-reads NGS company, and what it would take to acquire someone like Ultima Genomics, or Element Bio, or Singular Genomics.