JPM25 Exact Sciences $EXAS

Exact Sciences Corporation (EXAS), founded in 1995 and headquartered in Madison, Wisconsin, is a leading molecular diagnostics company specializing in the early detection and prevention of various cancers. The company's flagship product, Cologuard, is a non-invasive stool-based DNA screening test approved by the FDA in 2014 for the early detection of colorectal cancer and pre-cancer. Since its launch, Cologuard has played a significant role in cancer detection, identifying nearly 600,000 cases.

In addition to Cologuard, Exact Sciences offers a range of precision oncology products, including the Oncotype DX suite of tests. These tests provide genomic insights to inform prognosis and guide cancer treatment decisions, particularly in breast and colon cancers.

EXAS has a consistent increase in revenue, reflecting the growing adoption of its cancer screening and diagnostic tests.

Looking ahead, Exact Sciences plans to introduce the Cologuard Plus™ test in 2025, aiming to build on a decade of patient impact and further enhance cancer detection capabilities.

See below the highlights of their slide deck presentation at JPM25.

The company is solely focused on cancer, and the detection of it as well as informing the treatment of cancer.

They are starting 2025 kicking the door open with plans to launch 3 new cancer tests. This is a big endeavor for any Diagnostics company, and speaks favorably of the might that EXAS is showing with this ambition.

Cologuard Plus is the most advanced in the pipeline, aiming at early 2Q25, Oncodetect (Molecular Residual Disease, MRD) also for 2Q25, and finally, the biggest surprise announcement for EXAS out there: the new Multi-cancer Screening or Multi-Cancer Early Detection (MCED) assay, Cancerguard, aiming at 2H25.

EXAS is a big company, with 7000+ employees, delivering 4.5M tests per year, with a $2.76B in total revenue, up 10% YoY.

Part of the size of EXAS is due to the multiple acquisitions they’ve made in the last 5-10 years. Here showing their virtuous circle schema.

They split their franchises into Screening (where the money is) and Precision Oncology. Their most famous product continues to be Cologuard, a colorectal (CRC) cancer screening assay. The Screening line makes them more than 3/4 of the revenue.

Not everything is tests and lab work, EXAS also wants to emphasize that Data, Tools, and AI play an important part in their operations. They call all this ExactNexus, and they made a concerted effort to improve the software in 2024.

Cologuard has become synonymous with colon cancer screening and saved the US healthcare system an alleged $22B, which I am pretty sure is much more than the historical revenue EXAS has made from it. The chart shows how adoption is increasing. Cologuard is currently an alternative to colonoscopy, which is an invasive, sometimes damaging procedure that many of us would want to avoid.

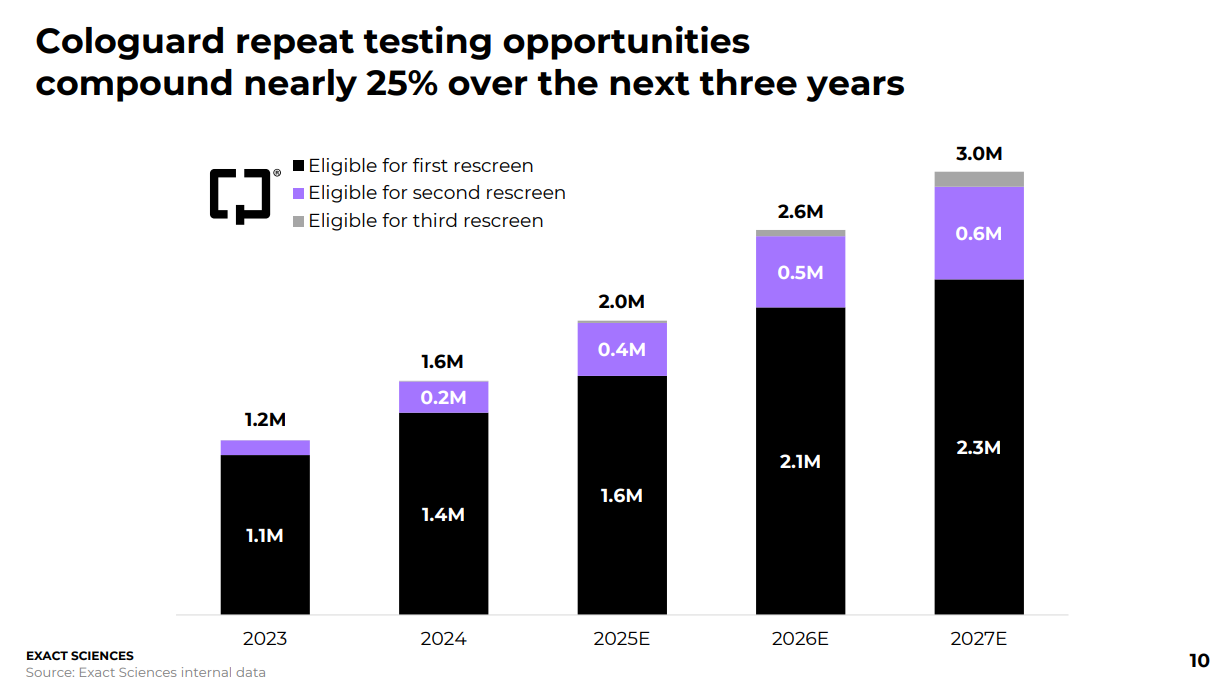

The Cologuard franchise keeps growing, 21% 5-year CAGR, estimated to have made EXAS a total of $2.104B in 2024. Because it’s a screening assay, people could be getting it as frequently as once a year for the group risks of 45+ yo, 50+ yo in some geographies.

The repeated testing opportunity shows here in the slide, with now 0.2M of the tests performed being eligible for second rescreen, compared to the 1.4M first screen.

In the US, dealing well with reimbursement is a big deal. Medicare and the Medicare Advantage plans cover 34.2 million and 31.6 million respectively. The enrollment in Medicare Advantage plans has been steadily increasing over the years, reflecting beneficiaries' preference for the additional benefits and coordinated care these plans often offer. EXAS sees a 1M+ annual test opportunity from Medicare Advantage.

Moving on to Oncotype DX, EXAS has published some studies on its use, like TAILORx (10K women, 12 years) and RxPONDER (5k women, 5 years).

The adoption is also growing, but it only made $655M for EXAS in 2024, a considerably smaller number than Cologuard revenue.

EXAS lays out their plan for success with Technologies (DNA preparation, sample prep, NGS, PCR, AI/ML and Bioinformatics), Multi-omics now including DNA, RNA, and Proteins, and Collaborations, e.g. Johns Hopkins, Broad institute, May Clinic, and more recently Ultima Genomics.

Moving on to the future of the Cologuard franchise: Cologuard Plus was announced 2-3 years ago, it’s now only months from being fully launched. It’s at 95%/94% sens/spec with the specificity including no findings on colonoscopy, which here is used as the grown truth.

Below I’ll cover the Cancerguard announcement and others, and give my opinion on where I think EXAS can go from here in 2025.