JPM25: Grail Bio $GRAL

GRAIL, Inc., founded in 2015 and headquartered in Menlo Park, California, is a biotechnology company specializing in early cancer detection technologies. Initially a subsidiary of Illumina, GRAIL was spun out and began trading on the Nasdaq under the ticker symbol GRAL in June 2024, with Illumina retaining a 14.5% stake.

The company's flagship product, the Galleri test, is a blood-based multi-cancer early detection (MCED) assay capable of identifying over 50 types of cancer. Priced at $949, Galleri is currently available in the United States and is recommended for adults aged 50 or older with an elevated risk of cancer. The test is intended to complement existing cancer screenings, such as mammography and colonoscopy.

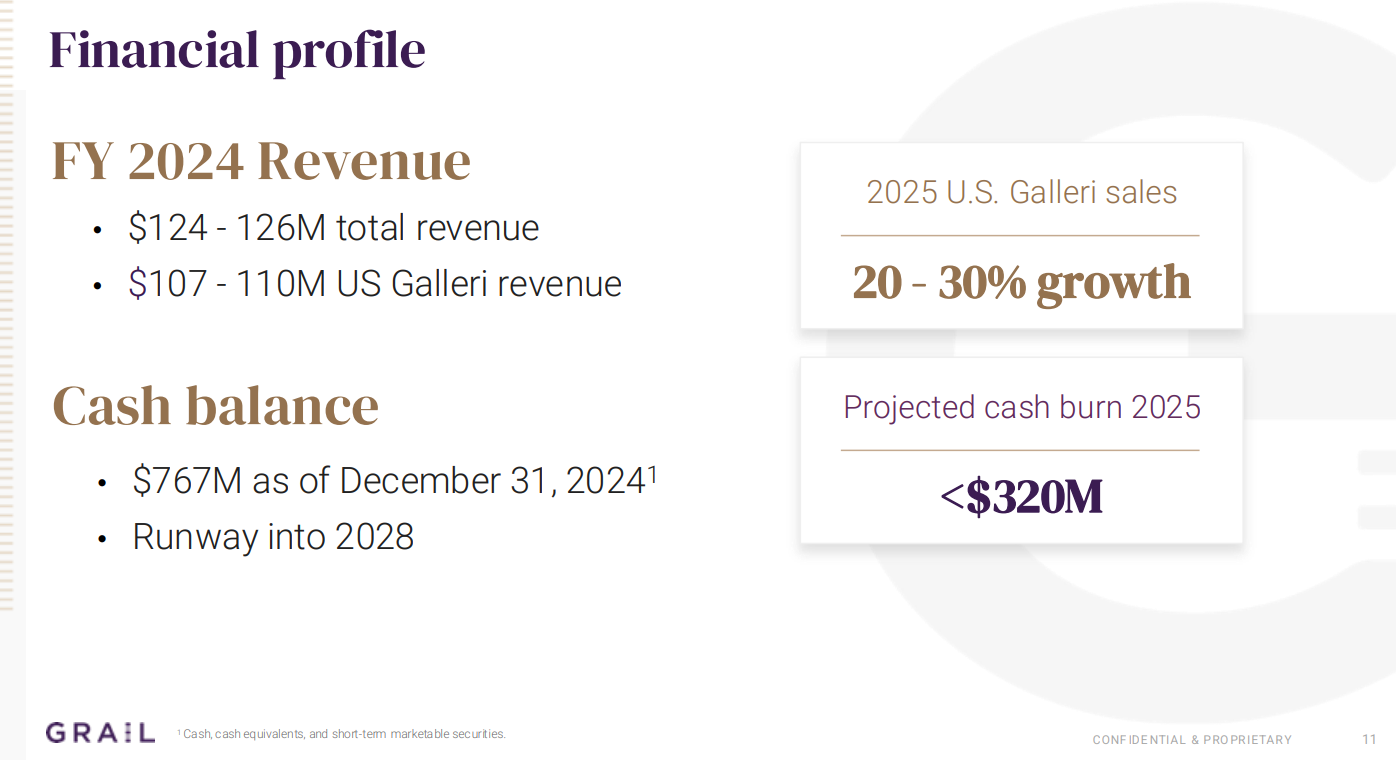

In August 2024, GRAIL announced a restructuring plan, reducing its workforce and planned hires for 2024 by approximately 30% to focus on the development and commercialization of the Galleri test. This initiative aims to extend the company's cash runway into 2028 and reduce its spending to $325 million by 2025. During the second quarter of 2024, GRAIL reported a 43% increase in revenue, reaching $32 million, with over 215,000 Galleri tests sold during the period.

Below I will highlight the JPM25 presentation that Grail Bio gave, and where I think Grail Bio could go from here.

Grail Bio has an interesting profile when it comes to Diagnostics companies, as it came out of the gates attempting to tackle one of the most difficult types of assays, Multi-Cancer Early Detection (MCED). Galleri now sells >290,000 per year, but the adoption rate is still a tiny fraction of the total possible.

The premise for MCED: cancer still kills a lot of people that weren’t screened. With early screening, the survival rate increases by 4-fold. That’s 4 times more chances of surviving if it’s detected early (Data on file from Surveillance, Epidemiology, and End Results (SEER) 18 Regs Research Data, Nov 2023 Submission. Includes persons aged 50 – 79. Estimated deaths per year in 2020 from American Cancer Society Cancer Facts and Figures 2020. Available at: www.cancer.org/content/dam/cancer-org/research/cancer-facts-and-statistics/annual-cancerfacts-and-figures/2020/cancer-facts-and-figures-2020.pdf).

Grail’s solution to this problem is Galleri: a clinically-validated, commercially-available MCED test (the only one of its kind so far). A simple blood test, designed with a very low false positive rate, and predicts “tissue of origin”.

The results of the PATHFINDER trial show that Galleri more than doubled the number of cancers identified compared to the equivalent solutions out there. An impressive 88% localization accuracy shows that the use of methylation is key in the performance of the assay.

Grail has now put out a new version, presumably software, which improves signal of origin (CSO).

Given that the estimated global economic cost of cancer care for 2020-2050 will be $25T, any improvements on the current situation will be very invaluable indeed. The US screening population is at >100M (representing adult population between 50-79 years of age). Adding EU, UK and Japan, that’s >300M people. So if 300M people were assayed with Galleri annually ($995), that would be $300B in revenue annually, which is what Apple makes since the last few years.

The numbers currently look as shown above: 137K tests sold in FY24, which is about $136.3M in revenue, a nice increase over 2023 which itself was a nice increase over 2022 and 2021.

An example of the types of cancer identified at Stage 1 and Stage 2, and a quote from someone how benefited from it.

Given that the revenue all comes from Galleri, the only numbers to look at are if it’s total revenue or US Galleri revenue, showing that there is a small percentage now coming from overseas. Since the cash burn is still a bit below triple the revenue, Galleri needs to be careful in spending money. They have a runway into 2028 of $767M as of end of 2024.

The company is scaling lab operations, furthering clinical programs and showing they can execute on a total now of >600,000 clinical and commercial assays performed and >300 publications and presentations from this work.

The strategic priorities for 2024 included the Corporate re-structuring, which happened in August. In December, they began transitioning to the new version of Galleri (software update?). For 2025, the priorities are to Seek FDA approval for Galleri, which opens up a whole host of reimbursement opportunities, and Pursue CMS coverage and broad commercial reimbursement for Galleri. CMS (Centers for Medicare & Medicaid Services) coverage means that the test would be covered under the U.S. federal healthcare programs, including Medicare (primarily for seniors aged 65 and older) and Medicaid (for low-income individuals and families). The PATHFINDER 2 and the NHS partnership in the UK will provide trial data in 2025, and it is expected that the modular PMA submission to the FDA will also complete. A modular PMA (Premarket Approval) submission to the FDA refers to a phased process where a medical device or diagnostic company submits sections of its application incrementally, allowing the FDA to review each module as it is received.

Strategic Positioning

Below I’ll describe where I see Grail Bio GRAL 0.00%↑ currently, where they could go from here and what the competition could entail for them.