JPM25: Guardant Health $GH and Medicare news

Guardant Health, founded in 2012 by Helmy Eltoukhy and AmirAli Talasaz, is a leading precision oncology company dedicated to transforming cancer care through data-driven approaches. The company specializes in developing blood-based tests, known as liquid biopsies, which detect and monitor cancer by identifying tumor-derived genetic material circulating in the bloodstream. This non-invasive method offers a safer and more accessible alternative to traditional tissue biopsies.

In 2022, Guardant Health introduced Shield, a blood-based test designed for colorectal cancer screening. Shield received FDA approval in July 2024, making it the first blood test authorized for colorectal cancer screening in the United States. This approval was based on clinical trials demonstrating an 83% detection sensitivity rate.

Following FDA approval, Shield was granted a Medicare reimbursement rate of $920 per test, effective August 1, 2024, enhancing its accessibility to a broader patient population.

The launch of Shield has significantly impacted Guardant Health's financial performance. In the third quarter of 2024, the company reported a 34% increase in revenue, totaling $191.5 million, attributed to strong clinical and biopharma test volumes, including the successful introduction of Shield. This financial growth led to an upward revision of the company's annual revenue guidance to a range of $720 million to $725 million.

Despite these advancements, Guardant Health faces competition in the blood-based cancer screening market. Exact Sciences, for instance, has announced promising results for its own blood-based cancer test, claiming superior early detection capabilities. However, larger-scale studies are needed to confirm these findings and secure regulatory approval.

Below I will highlight the presentation that Guardant Health GH 0.00%↑ gave at JPM25.

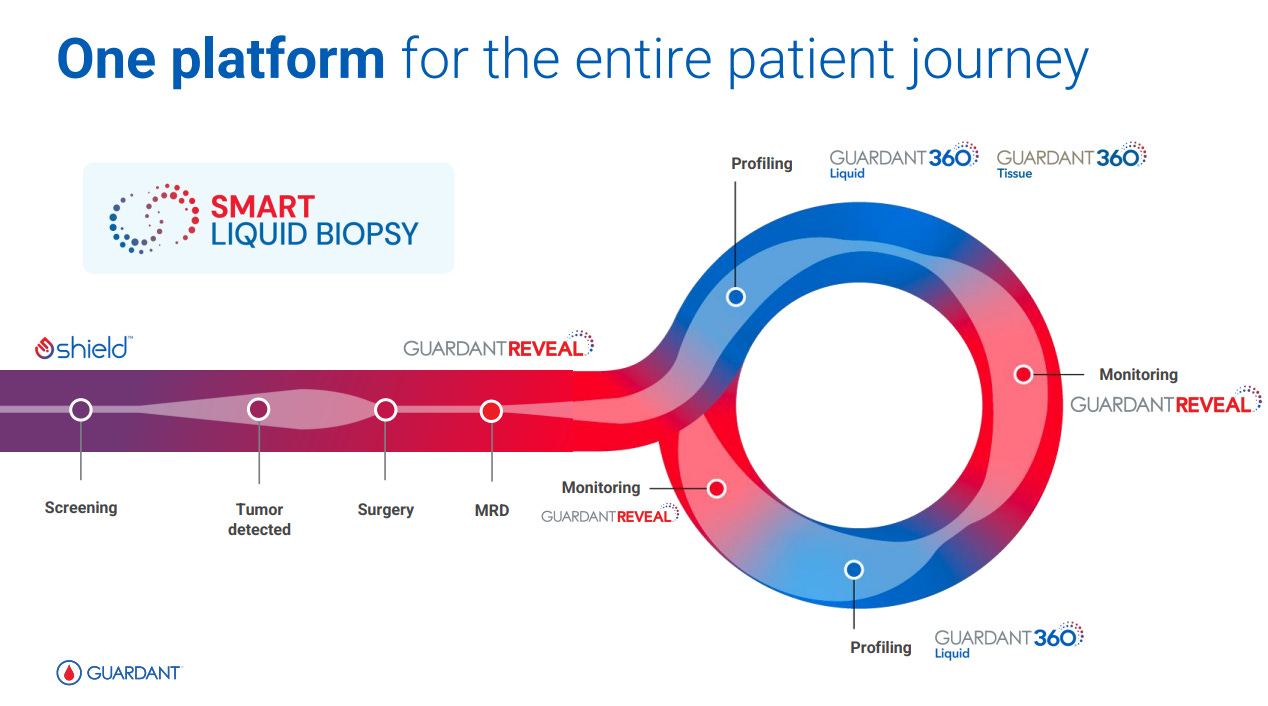

The chart of the company’s offerings in terms of assays, with the left-most being a Screening product for the average risk US patient (45-50+): SHIELD, which received FDA approval in August 2024. The mid and right-hand side of the chart are the products that inform on the MRD of the cancer with Guardant REVEAL, e.g. after Surgery or Adjuvant treatments, and the Therapy Selection is now the most classical set of assays, with 360, 360CDx, 360TissueNext and 360Response.

The company showed strong results in FY2024, with a 31% rate of growth YoY.

Splitting into the 3 categories of products, 2024 was a busy year for GH: demonstrating that G360 is a profitable core business, with increased G360 ASP, the launch of a Smart Liquid Biopsy for G360, volume growth in US and international expansion.

In MRD, GH published data for their CRC product, and is working on Breast cancer next. There was a volume growth in this REVEAL product.

In Screening, the Shield FDA approval kickstarted the adventure of GH into cancer screening, which they hadn’t been doing until now. Regarding Shield Medicare reimbursement, they received good news lately, which we will cover at the end of this post.

In Therapy Selection, the most mature of the product line, GH sees a TAM of $10B, taking into account that there are 700K US patients with advanced cancer on a given year.

G360 grew 34% YoY, totalling $541M of revenue in FY24. GH sees tailwinds in ASP + Reimbursement, which shows a promising path forward for this product line. Even if an assay is priced at a certain value by a diagnostics company, the important metric is how much will people or insurance companies actually pay for it. ASP (Average Selling Price) refers to the average price at which a test is sold after accounting for negotiated discounts, payer contracts, and other factors. Reimbursement is a factor for the ASP of a test, so seeing good numbers on both is always a good sign for a diagnostics company.

G360 ASP is now at around $3000, a goal the company had set up to achieve in 4 years time. Tissue Medicare pricing went up from $3100 to $3500 in 2025. More good news on private payer coverage and opportunities to further expand commercial coverage.

A chart showing the product profile for G360: a panel of 740 Genes, with a 7-day Turn-Around Time (TAT). The “comprehensive epigenomics backbone” probably refers to the fact that many of these genes are also in the epigenomic-profiling SHIELD screening product.

In 2025, GH intends to launch the G360 Tissue product, which could be a blend of classic G360 with what the company learned from Reveal and Shield in epigenomic-profiling.

In terms of biopharma customers, GH also saw good YoY growth, with 31% at $145M FY2024 revenue. The customer list includes 19 out of the top 20 pharma companies.

Going into MRD, GH sees the TAM as double what it was for the G360 product line, at $20B. Given that the total of potential customers in the US is 18M, much bigger than the 700K for G360, it means that each MRD assay is worth less money than what the company intends for G360.

GH sees a large market that can only be addressed by tissue-free MRD. To exemplify what this means, GH puts 12M+ patients at 5 years or more post surgery out of the 18M, which means they can continue being assayed with a liquid biopsy product.

Reveal was tested on around 2,000 samples from 342 CRC patients undergoing curative intent therapy and received an 81% sensitivity at 99% specificity, with a Limit of Detection of 0.005% for only 5ng of DNA in a liquid biopsy sample. It is common to be in the 6-12ng range for blood samples in the 10-20ml range (size of a lipstick), so having good performance at 5ng is important to be able to perform an assay on most of the samples received.

GH wants to see the Reveal product line go into other avenues, such as Breast, Therapy Monitoring and other indications. The company is working on studies such as PEGASUS (Colon), TRACC Part C (CRC) and ACT-3 (Colon) at different Phases of the trial.

Another chart showing the different steps in assaying cancer. All based on what GH calls Smart Liquid Biopsy.

Finally we go where the money is at: screening. I’ll continue highlighting the presentation, cover the recent Medicare reimbursement news and give my personal opinion on where GH could go from here onwards.