JPM25: Recursion $RXRX

Recursion Pharmaceuticals (RXRX) is a clinical-stage biotechnology company that integrates advanced technologies across biology, chemistry, automation, data science, and engineering to industrialize drug discovery. The company's drug discovery pipeline encompasses various stages of development, including clinical and preclinical programs, as well as advanced discovery initiatives.

In August 2024, Recursion announced a definitive agreement to acquire Exscientia, another leader in AI-driven drug discovery, in an all-stock deal valued at approximately $688 million. This strategic merger aims to create a global technology-enabled drug discovery leader with end-to-end capabilities, combining Recursion's scaled biology exploration and translational expertise with Exscientia's precision chemistry design and automated synthesis. The combined entity is expected to achieve annual synergies exceeding $100 million.

Earlier, in May 2023, Recursion expanded its AI-driven drug discovery capabilities by acquiring two Canadian companies: Cyclica, for $40 million, and Valence, for $47.5 million. These acquisitions bolstered Recursion's chemistry and generative AI expertise, enhancing its ability to predict molecular interactions and design novel compounds.

In July 2023, Recursion secured a $50 million investment from NVIDIA to accelerate the development of its AI foundation models for biology and chemistry. This collaboration also includes potential utilization of NVIDIA's cloud services for distribution, further strengthening Recursion's computational infrastructure.

Additionally, Recursion has established significant partnerships with major pharmaceutical companies. In September 2020, the company entered into a strategic collaboration with Bayer to discover and develop treatments for fibrotic diseases, which was later expanded in 2023 to include oncology research.

These collaborations underscore Recursion's commitment to leveraging AI and machine learning to accelerate drug discovery and development across various therapeutic areas.

JPM25 Recursion presentation

Below I will give commentary on the slide deck that RXRX presented at JPM25.

The Recursion OS is predicated on industrializing first-in-class and best-in-class drug discovery, by modelling real world specimens to then model it to then feed the pipeline of drug discovery.

The portfolio for RXRX, including the acquired assets from Exscientia, is poised for value creation with waves of new pipeline and partner programs emerging from Recursion OS. RXRX wanted to have assets do develop while building the RXRX-OS, and those were via partnership. But once the RXRX-OS system is up and running, the company then generates assets from their own programs which they themselves can enter partnerships for development with the likes of Sanofi, Roche/Genentech, Bayer or Merck. There are $450M in the accounts from upfront and milestone payments earned to-date, with a much larger value of $20B in potential milestone payments should all of these succeed.

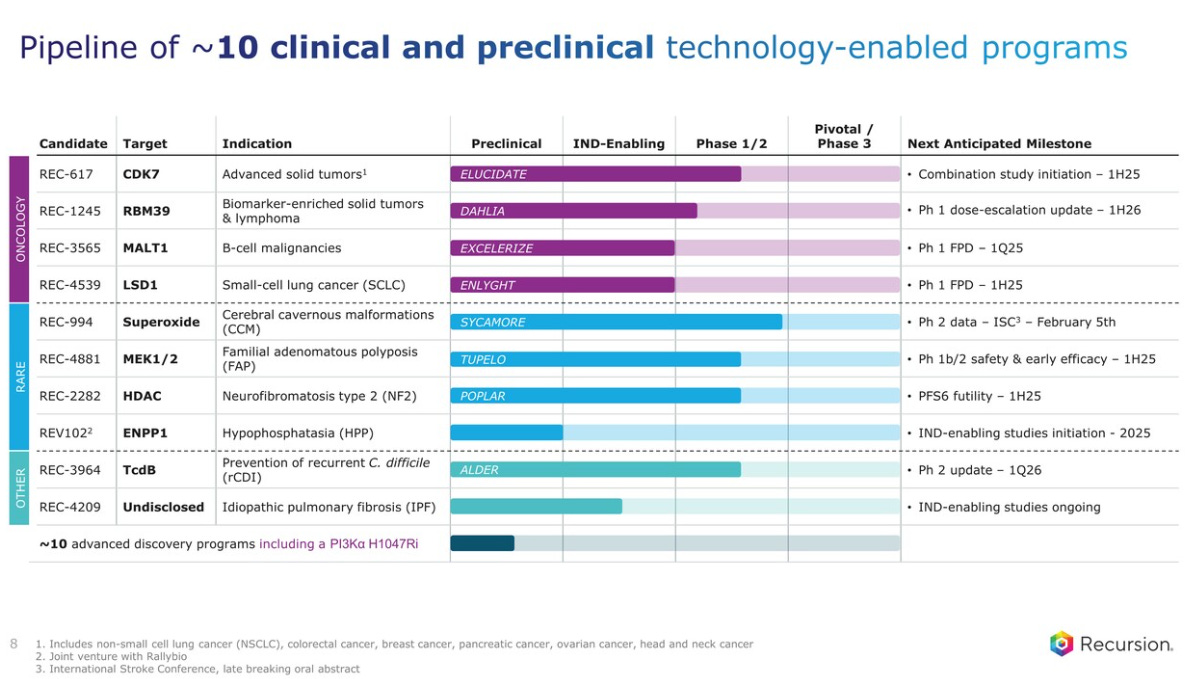

A table of 10 clinical and preclinical assets is shown, with an equal mix of oncology and rare diseases, and two more in C. difficile infections and Idiopathic pulmonary fibrosis (IPF). Each of the three buckets has assets in Phase 1/2, with REC-994 being the most advanced.

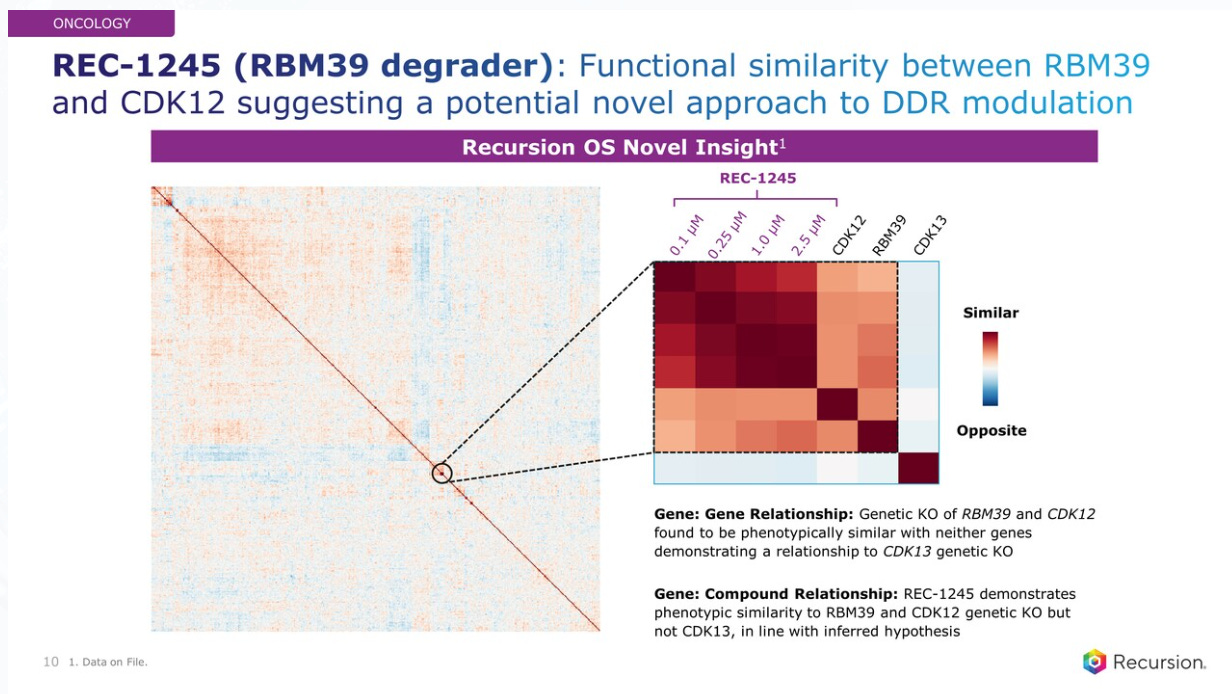

In oncology, REC-1245 comes from the discovery via the RXRX-OS, with the combination of Genomics, Transcriptomics, Phenomics (imaging) and Proteomics as well as InVivomics (In Vivo studies), driving to a Target and Pathway Deconvolution and In Vivo Toxicity Prediction which made this target go into the drug discovery pipeline.

The science behind this RBM39 degrader. A new compound, REC-1245 demonstrates similarity to the phenotype of an RBM39 and CDK12 genetic KO but not CDK13, which is the opposite phenotype to those two.

The first dosed patient was in 4Q24, and RXRX believes this is a compelling dose-dependent antitumoral drug. The expected update on Phase 1 dose-escalation is in 1H26.

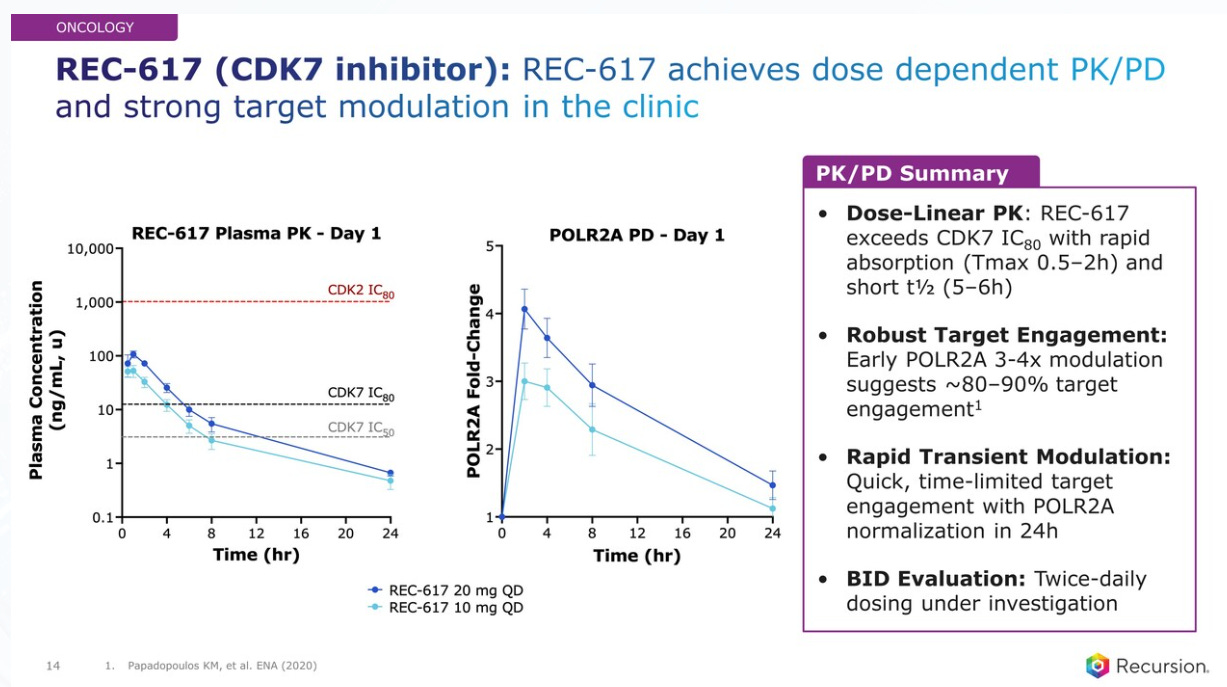

The next in the Oncology list is REC-617, a CDK7 inhibitor with reduced transporter interactions intended to minimize gastrointestinal (GI) adverse events seen with prior molecules in this class.

A dose escalation graph shown for the Phase 1 design. A dose escalation clinical study is a type of research trial where different doses of a drug are gradually tested on groups of participants to determine the highest dose that is safe and well-tolerated. It helps identify the optimal dose to use in later stages of clinical testing. Researchers closely monitor participants for side effects and effectiveness as the doses increase.

The data so far for REC-617 shows dose dependent pharmacokinetics and pharmacodynamics and strong target modulation in the clinic. Strong target modulation in the clinic indicates that the drug effectively interacts with and influences its intended biological target, achieving the desired effect at appropriate doses.

RXRX believes that REC-617 has a competitive and unique profile. One way of measuring this is the therapeutic index. The therapeutic index is a measure of a drug's safety, comparing the dose that produces the desired therapeutic effect to the dose that causes harmful side effects. A higher therapeutic index indicates a wider margin between effective and toxic doses, meaning the drug is generally safer to use. It helps determine the appropriate dosing range for maximizing benefits while minimizing risks.

So far, REC-617 shows durable monotherapy partial response in a metastatic ovarian cancer patient after 4 prior lines of therapy didn’t fully resolve the cancer incidence. This means that REC-617, used on its own (monotherapy), significantly reduced the size or extent of the cancer. "Durable" indicates that this response was maintained over an extended period, showing the drug's effectiveness and potential to provide lasting benefit even in a patient with heavily pre-treated, advanced-stage cancer.

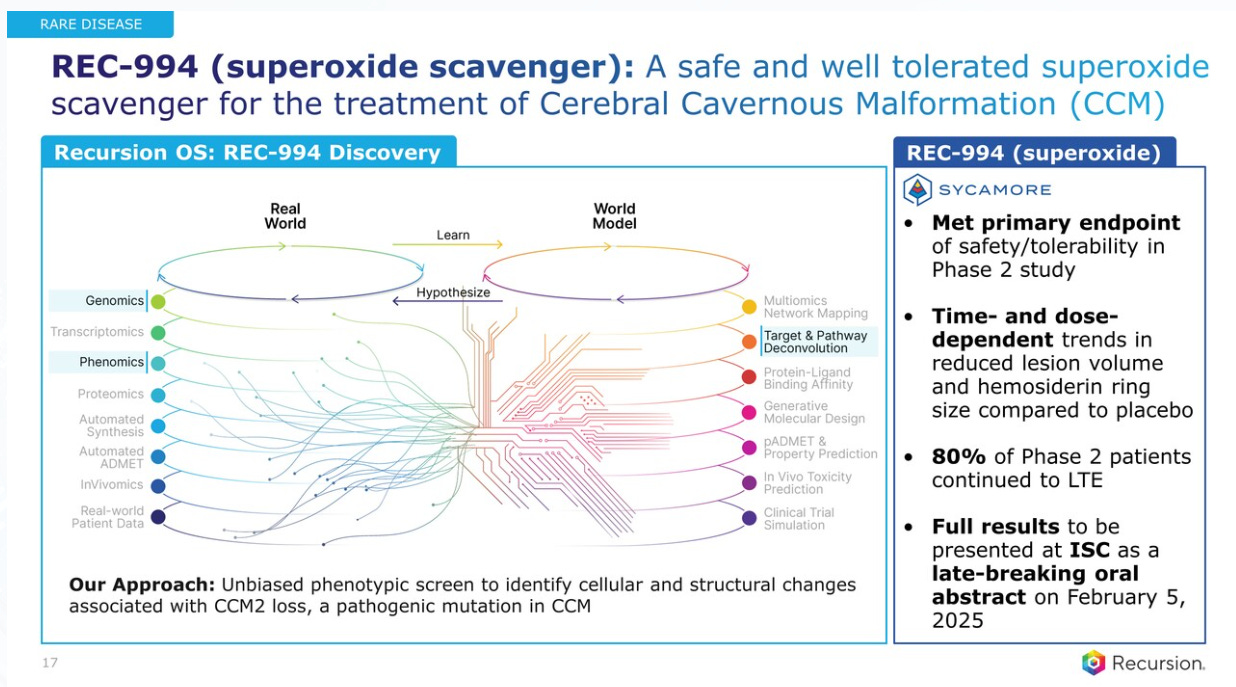

After discussing 2 of the Oncology drugs, RXRX moves to Rare Diseases, starting with REC-994, a superoxide scavenger for the treatment of Cerebral Cavernous Malformation (CCM). They showed the drug meeting primary endpoint of safety/tolerability in a Phase 2 study. This means the trial successfully demonstrated that the drug is generally safe for patients to take and that its side effects are manageable. This outcome is crucial for assessing whether the drug can proceed to further testing in larger trials while continuing to evaluate its effectiveness. An equivalent to "endpoint" in this context is goal or objective.

The second of the rare diseases is a MEK1/2 inhibitor that they’ve already dosed at 4mg QD (once daily) showing it to be pharmacologically active and well-tolerated. It has a differentiated ADME profile (absorption, distribution, metabolism, and excretion).

Next is REV102, which wants to compete against other ENPP1 inhibitors. It’s in IND-enabling study design phase due to start in 2025. A drug in the "IND-enabling studies" phase is undergoing preclinical testing to gather the data required to submit an Investigational New Drug (IND) application to regulatory authorities. These studies evaluate the drug’s safety, toxicity, pharmacokinetics, and pharmacodynamics to ensure it is safe to begin testing in humans. This phase is a critical step before starting clinical trials.

Outside of Oncology of Rare Diseases, RXRX is working on REC-3964, a non-antibiotic oral treatment for a C.diff. infection of the bowels. They’ve already identified 30+ new trial sites using their software, which means there is a potential list of participants that are suitable for a trial of this new drug.

Now onto Partnership assets. I’ll describe these slides as well as the slides describing the leadership team, then go into what I think could be in store for RXRX in 2025.