JPM25: Tempus AI $TEM

Tempus AI, founded in 2015 by Eric Lefkofsky, is a health technology company based in Chicago, Illinois. The company specializes in utilizing artificial intelligence to develop precision medicine solutions, including diagnostics for oncology, cardiology, and depression.

Tempus offers a range of AI-enabled products designed to enhance patient care:

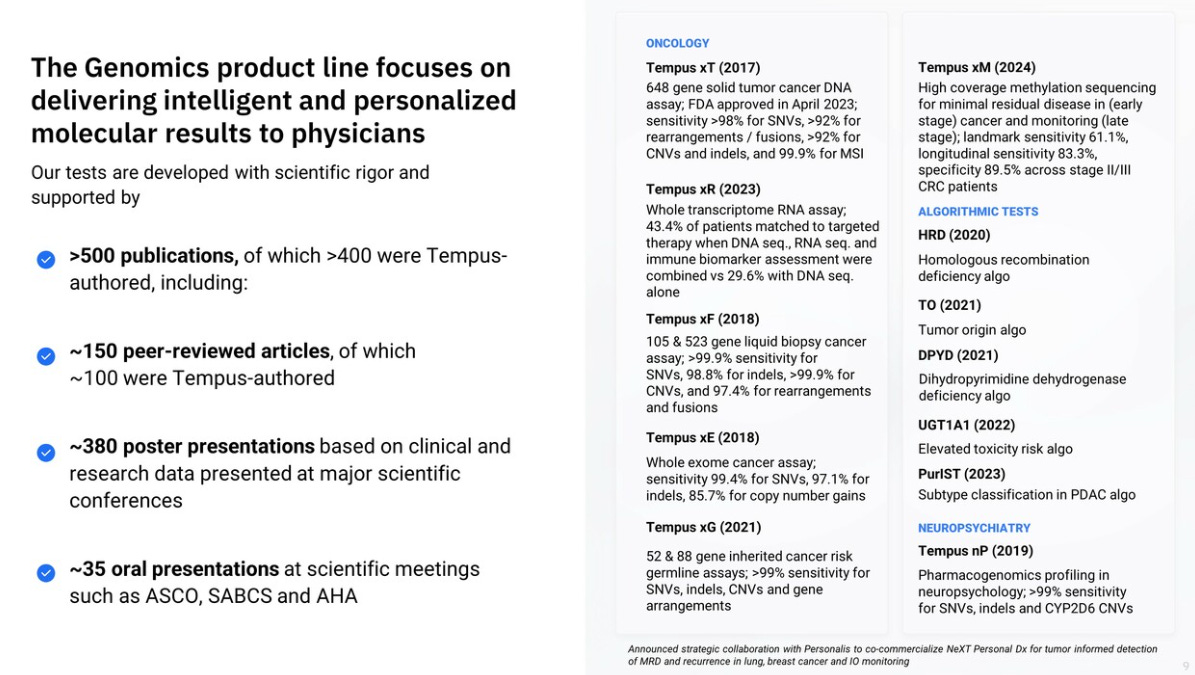

Genomic Diagnostic Tests: These tests provide comprehensive genomic profiling to inform treatment decisions across various medical fields, including oncology, neuropsychiatry, radiology, and cardiology.

Tempus Next: An AI-enabled care pathway intelligence platform that identifies care gaps and provides clinicians with actionable insights at the point of care, supporting access to the most up-to-date, guideline-directed treatments.

Tempus ECG-AF: An AI-based algorithm that identifies patients at increased risk of atrial fibrillation (AFib). This device received 510(k) clearance from the U.S. Food and Drug Administration (FDA) in June 2024.

In addition to its product offerings, Tempus has engaged in several strategic collaborations to advance therapeutic development:

Pfizer: A multi-year collaboration to further AI and machine learning-driven efforts in oncology therapeutic development.

Genialis: A collaboration to develop RNA-based biomarker algorithms across cancer types, leveraging Tempus’ multimodal dataset.

BioNTech: A multi-year collaboration to enhance BioNTech’s next-generation oncology pipeline using Tempus’ large multimodal datasets.

SoftBank Group: A joint venture to introduce AI-backed medical services in Japan, analyzing patient data to offer doctors treatment options.

The presentation at JPM25 was done on Monday 13th, the company stock TEM 0.00%↑ is up 4.30% in pre-market at the time of writing this post. The company has been in the $30-50 range for most of the 5-6 months of trading since the IPO, with two peaks above $70 in between.

Here is my commentary on the JPM25 slide deck.

Tempus AI believes that the time is now to capitalize on recent advancements, including generative AI, to transform healthcare, starting with diagnostics.

The combination of Data and Diagnostics is the starting point for Tempus AI (TEM) to build a leading AI-enabled Dx platform.

TEM wants to make sure their list of partnerships and collaborations connect them deeply with institutions that collect real-time clinical, molecular, and imaging data, hopefully scaling up to millions of cancer patients.

Compared to one of the largest public domain cancer datasets, the TCGA with about 10,000 DNA+RNA profiles, TEM wants to grow from a starting point of >250,000 DNA+RNA profiles, into >1,100,000 sequenced samples, 1.2M imaging records and 8.5M clinical records. Their claim to have already achieved partnerships with more than 65% of all AMC centers in the US and >50% of oncologists in the US shows how big their ambition is.

The three product lines are integrated: Genomics, Data and Applications. A flywheel that keeps accelerating, the more patients sequenced, the more data collected, allows TEM to provide additional insights.

In Genomics, TEM currently has Oncology products such as Tempus xT (648 gene panel DNA assay), Tempus xR (whole transcriptome RNA assay), Tempus xF (smaller cancer gene panels aimed at liquid biopsy), Tempus xE (whole exome cancer assay), Tempus xG (52/88 cancer gene panel for cancer risk on germline), and Tempus xM (high coverage methylation sequencing for MRD and cancer monitoring). The Tempus xM assays is probably the most adventurous of the whole list, as methylation sequencing isn’t something all Cancer Dx companies have delved into (yet).

The premise is that different stages of cancer need different assays, here starting with ctDNA in Early Stage detection with xG/xG+ and xM, then the Late Stage part is covered by the rest of the assays, with xG/xG+ and xM also playing a role in monitoring.

TEM wants you to know what their partnerships and collaborations bring to the table, and Ambry Genetics is an example of this mindset.

Data and Services is the second line for TEM to monetize. This could be via licensing of libraries of de-identified clinical, molecular, and imaging data together with the tools to inform the work that pharma and biotech would do with these.

They’ve already done this, with some retention metrics on existing contracts above.

Finally, the third stream is Applications, in 3 therapeutic areas: Oncology, Neuropsychology and Cardiology. The premise is that “vast amounts of molecular data across indications” and a “data business to structure and harmonize it” will bring customers in to use the applications and gain insights relevant to physicians and patients.

The Tempus Operating System (TEM-OS) can be used to ensure that each patient is on the right therapeutic path.

The 2024 highlights include the new MRD line, currently for CRC along with expansion of a collaboration with Personalis PSNL 0.00%↑ for tumor-informed assays. More collaborations with the likes of Novartis, Takeda, Merck EMD, and Astellas among others. Continued progress with payors, e.g. with Cigna, Humana, BCBS Illinois, BS California and Avalon Healthcare. More work on algorithm development.

Below is the 2024 results, where I analyse and give my opinion on where could TEM go from here onwards.