Liquid Biopsy Cancer Screening Nov 2024 update

News from Exact Sciences, Guardant Health, MRD review, Natera, NeoGenomics, Personalis, etc.

It’s been an eventful month for Liquid Biopsy in Cancer Screening, with two of the largest players reporting their Q3 results with markedly different stock valuation outcomes.

Exact Sciences

Exact Sciences EXAS 0.00%↑ disappointed investors with their Q3 report, and the stock dropped around -22%, going below the $60 mark which it had reached a year ago.

The revenue didn’t grow massively for EXAS during Q3, although the trend is still in an upwards trajectory.

Revenue reached $544.9M for screening and $163.8M for Precision Oncology, which continues to emphasize the fact that Liquid Biopsy for Cancer Screening pays big bucks when done well, whereas having a product in Precision Oncology is less of a differentiator these days.

What was probably most concerning in the eyes of investors was the anticipation of lower adjusted earnings for the year. The company said it now anticipates full-year adjusted earnings in a range of $310 million to $320 million, compared to its previous outlook of $335 million to $355 million. It projects revenue of $2.73 billion to $2.75 billion, down from the earlier estimate of $2.81 billion to $2.85 billion.

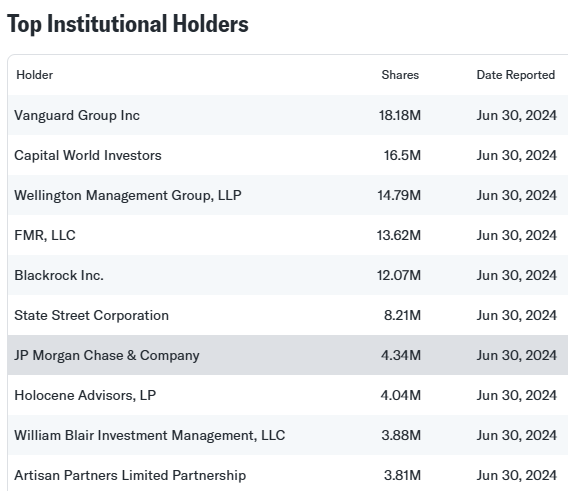

JPMorgan Chase is one of the Top 10 Institutional Holders, with more than 4M shares owned as of Jun 30, 2024 reports.

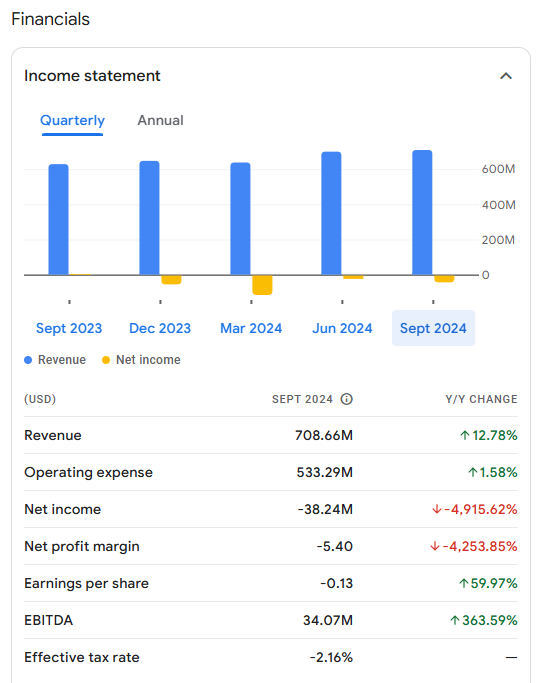

Guardant Health

On the other hand, Guardant Health GH 0.00%↑ also reported Q3 results, and the stock ramped up to the levels it had reached at the end of 2023. The stock currently trades at $28.59, which is just shy of the year high of £36.29.

JPMorgan Chase has since raised their price target for GH to $50.00, which is still a modest valuation considering that the stock reached $179.10 during the biotech boom years of 2021 and early 2022, when the COVID19 pandemic brought a disproportionate amount of optimism in biotech by investors worldwide. Goldman Sachs sticks to a $36.00 price target, which coincides with the year high in late summer of 2024 for the stock.

Even though JPMorgan Chase is bullish about GH, they aren’t in the top 10 Institutional Holders as of Jun 20, 2024 records. Maybe they’ll add to their position now?

MRD review

A review on the use of MRD has been published lately, which shows a growing trend of including Liquid Biopsy MRD NGS tests to complement the tissue-informed assays that have traditionally been used in the last couple of decades.

Natera’s Signatera and Guardant Health’s Reveal are at the top of the rankings in branding recognition, although NeoGenomics’ RADAR and Tempus’ xM are making good strides. Personalis shows its age in the segment, with only half the people recognising this long-standing brand compared to Natera.

Strategic positioning

If you have been following this account for a while, you’ve already seen me writing about EXAS and GH in the context of Liquid Biopsy for (Early) Cancer Screening, which is part of a segment that includes Precision Oncology and Genomic Diagnostics, transitioning into Next-Gen Sequencing and Proteomics.