Strategic Context: Roche's SBX and Clinical Assays

Roche's recent announcement of the SBX sequencer, specifically positioned to challenge Illumina’s dominance in short-read sequencing, represents a clear strategic move aimed at bolstering their NGS-driven clinical diagnostic capabilities. Roche, with deep strengths in diagnostics, oncology, and infectious diseases, sees the integration of NGS as a critical lever for driving diagnostic revenues and create a separation from Illumina. This announcement highlights a broader industry trend—traditional diagnostics and clinical assay players must acquire or develop advanced NGS capabilities to remain competitive and differentiate their clinical offerings.

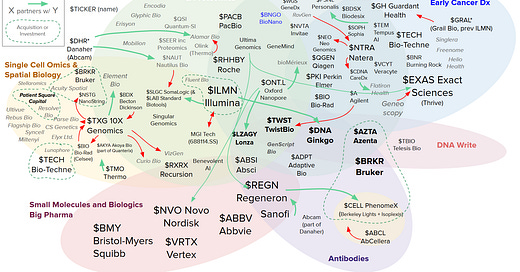

Appetites & Strategic Fits for Key Market Players

Below I analyse the strategic rationale and appetite among key diagnostics and life-sciences giants regarding potential acquisition targets like Ultima Genomics, Oxford Nanopore, PacBio, Element Bio, Singular Genomics, and multi-omics players like 10X Genomics:

1. Thermo Fisher Scientific

Appetite & Strategy: Thermo Fisher maintains a robust and diversified diagnostics and research solutions business. They previously acquired Ion Torrent (2014), demonstrating historical appetite for NGS acquisitions. Recently, they have strategically pivoted toward integrated, high-value clinical and translational markets.

Technological Complementarity: Interest would likely center on differentiated long-read or novel high-throughput sequencing platforms to complement their Ion Torrent short-read platform. PacBio or Oxford Nanopore, with clinical diagnostics potential and differentiated long-read capabilities, or multi-omics integration from 10X Genomics, would offer strong strategic complements. The company could also consider acquiring a ultra-high throughput short-read sequencer such as Ultima Genomics to boost their NGS-based Proteomics offering now that they have Olink in their portfolio.