Quantum-SI $QSI Q2 2023 results

What do they mean in the context of other Next-Gen Proteomics companies?

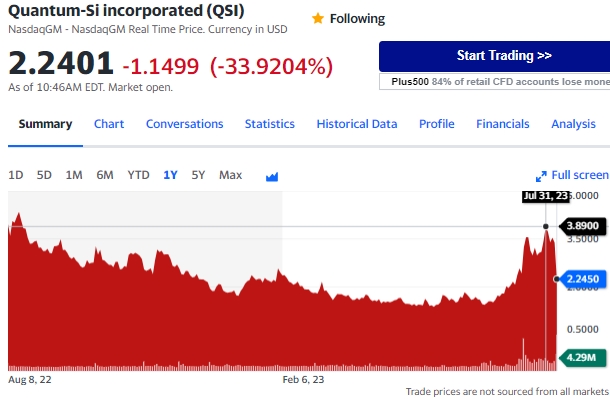

Quantum-SI QSI 0.00%↑ presented Q2 2023 results and the stock went down -33% at market open (7th August 2023).

The company said that the revenue for the quarter was $205,000, most of which was instrument revenue. Based on the numbers given, one would guess they sold 2 or 3 instruments in the quarter. It is difficult to say what the current install-base for Platinum is, but very little of the Q2 2023 revenue was due to reagents, thus instrument utilization.

If we look at similar companies out there, for example Illumina, they expect an “annual instrument pull-through” hopefully in the same ballpark as the price of the instrument. For example, for an Illumina NovaSeq6000, which costs $1 million, they would expect customers to spend $1M in reagents per instrument per year.

If we extrapolate these numbers to QSI’s Platinum, then all things going well, if they have 10 or 11 instruments in customer’s hands, they would expect an annual pull-through of $750,000. So they need to have about 1,000 instruments with that pull-through to make $75M a year, then possibly become profitable. At current rates of expenditure, that wouldn’t still be enough to be profitable.

Are 1000 Platinum instruments an unreasonable number? I don’t think it’s unreasonable, but the install-base could be dented once competition appears with their equivalent instruments.

Overall, it’s not too bad for the first company to successfully sell a Next-Generation Proteomics Sequencing method that doesn’t require a reference dataset like traditional Proteomics applications based on MassSpec (e.g. MASCOT or similar).

How is QSI progressing with full-profile NGPS and PTMs?

Certain amino acids have very similar structures, making it challenging to differentiate them accurately using mass spectrometry alone. For example: