Recursion Pharma at JPM26

Recursion Pharma presented at JP Morgan Healthcare 2026 and these are our highlights from their presentation.

Recursion (RXRX) makes medicines out of a unified, AI-native intelligence platform that decodes complex science to find new gene targets and indications for which other drug discovery platforms wouldn’t be able to find them. Originally based in Salt Lake city, they have since then acquired operations in London UK. They have assets progressing either from the original wave of discovery, the second wave of the fully fledged intelligence platform, or the third wave from the acquisition of Exscientia.

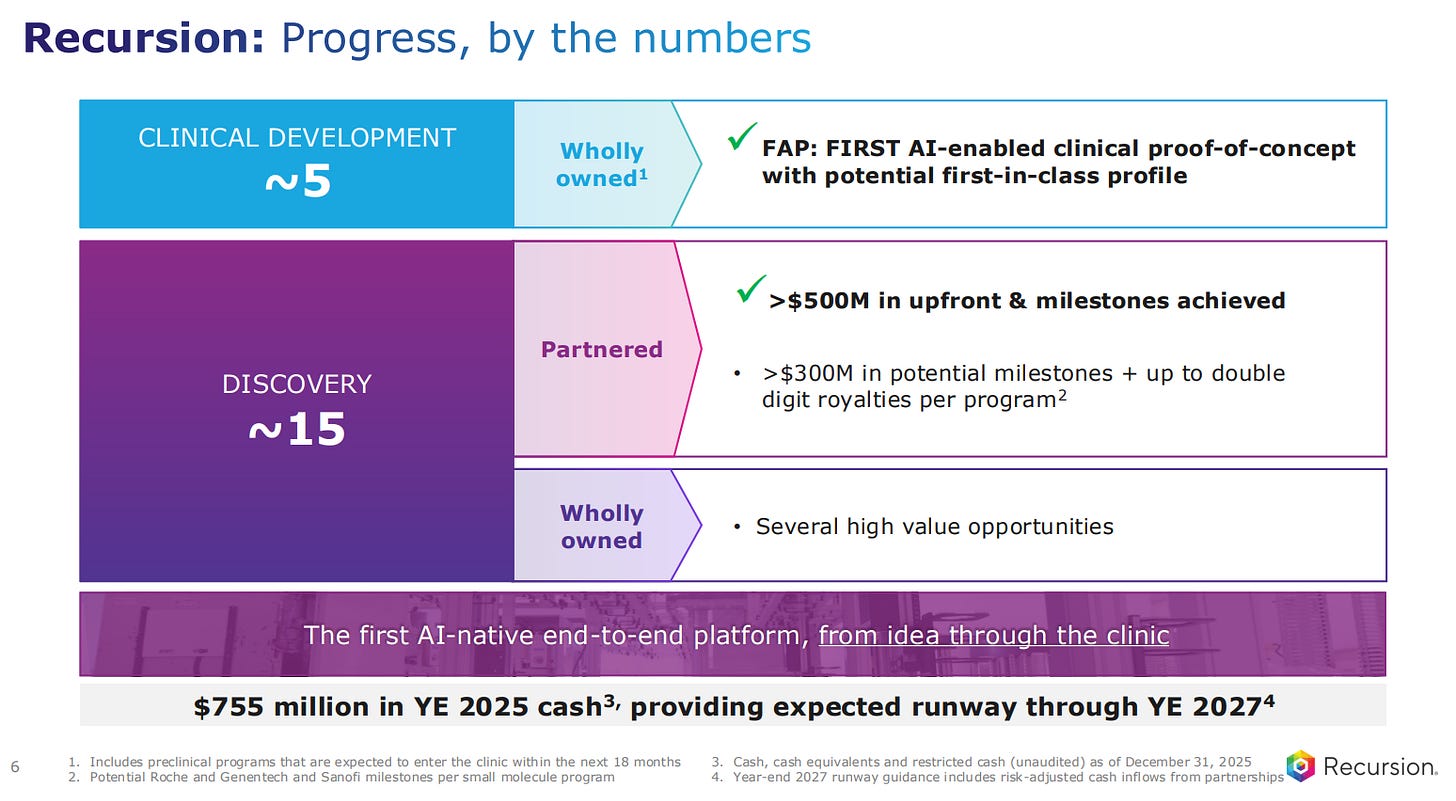

They have five assets in clinical development, wholly owned, with one of them coming from the first AI-enabled clinical proof-of-concept wht potential to first-in-class profile.

A first-in-class drug is the first medicine to work through a completely new biological mechanism to treat a disease, essentially opening up a new way of therapy. A best-in-class drug uses a mechanism that already exists but is considered the most effective, safest, or easiest to use among drugs in that category.

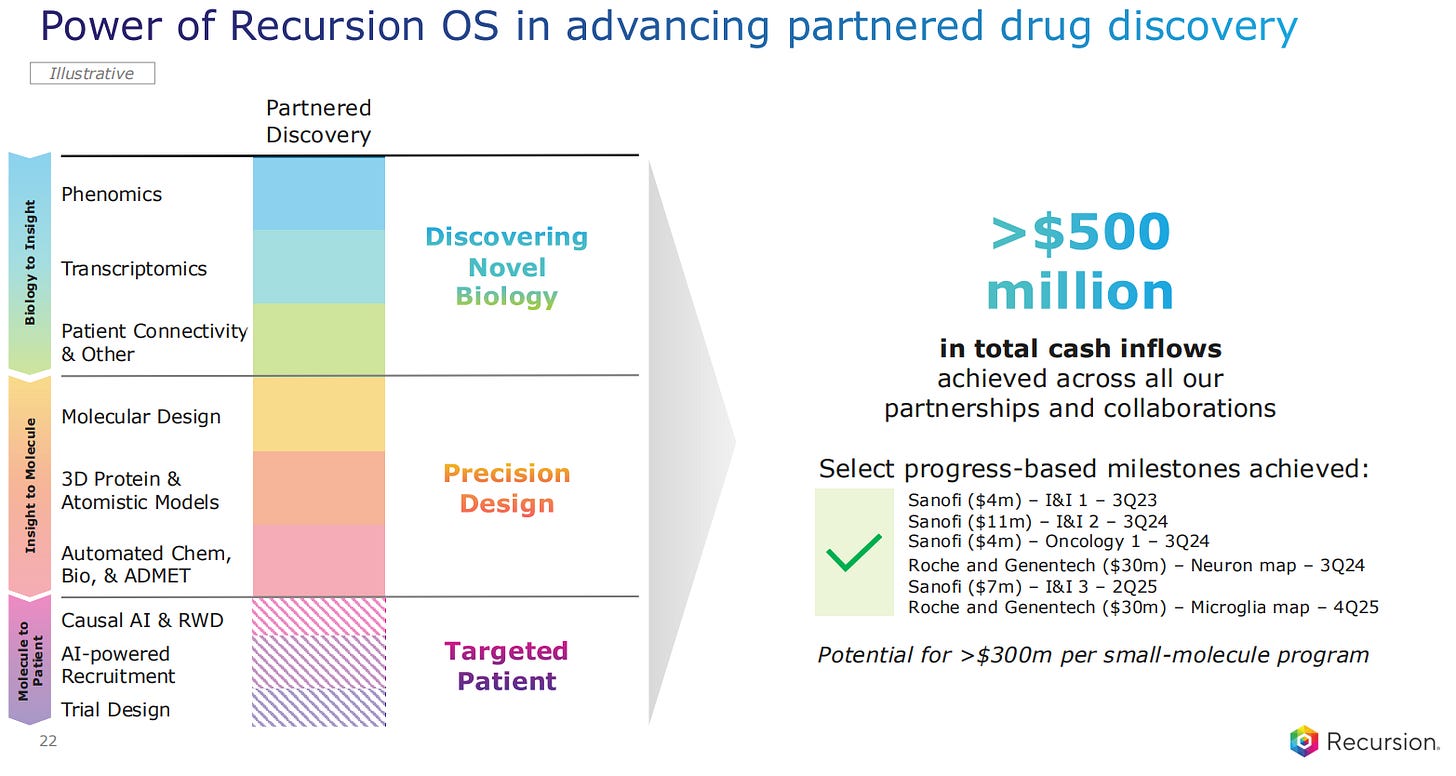

Beyond the five wholly owned assets, Recursion has 15 projects in discovery, many of them through partnerships bringing more than 500 million dollars in upfront and milestones achieved. There are another 300 million dollars in potential milestones and royalties where the percentage take from Recursion could be in the double-digits.

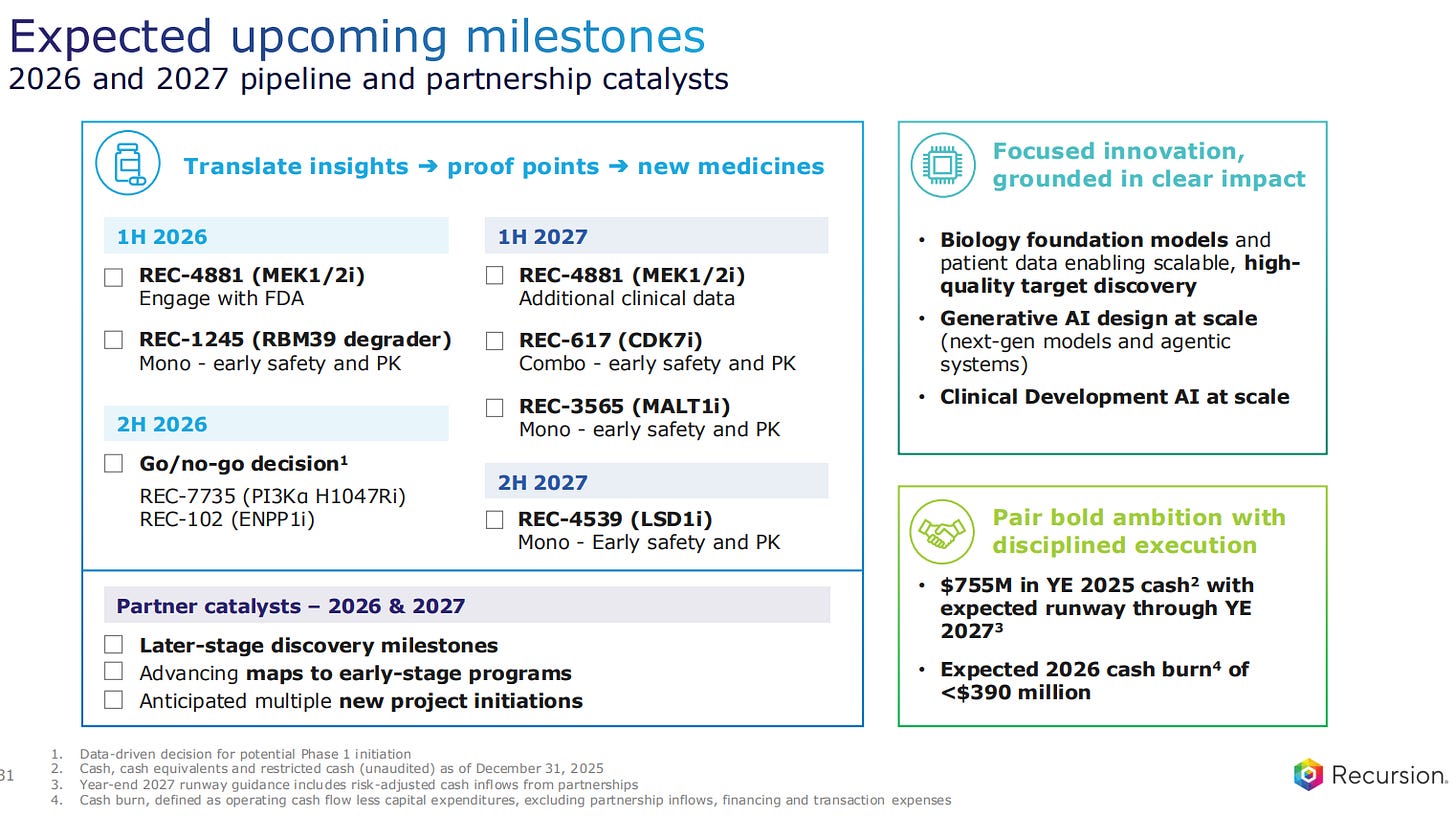

Recursion now has 755 million dollars in cash, which is currently a runway through the next 24 months.

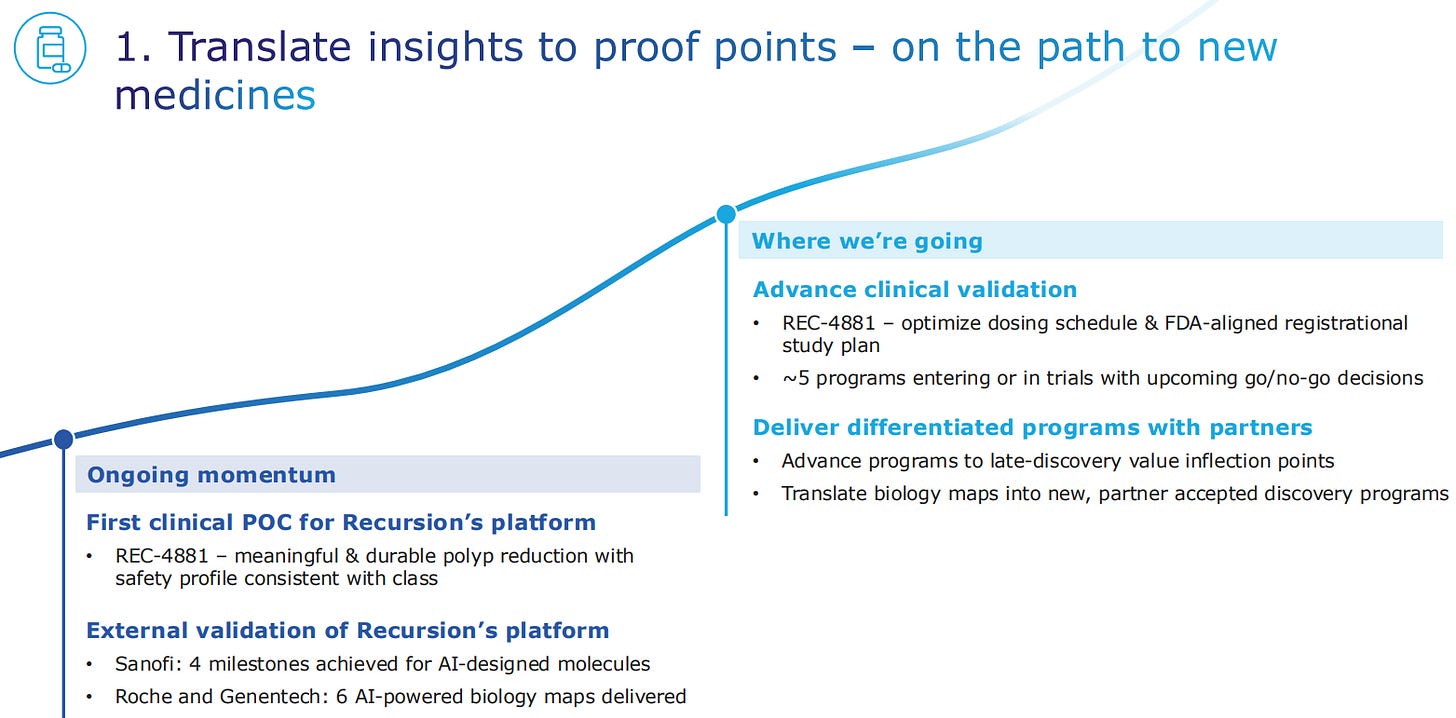

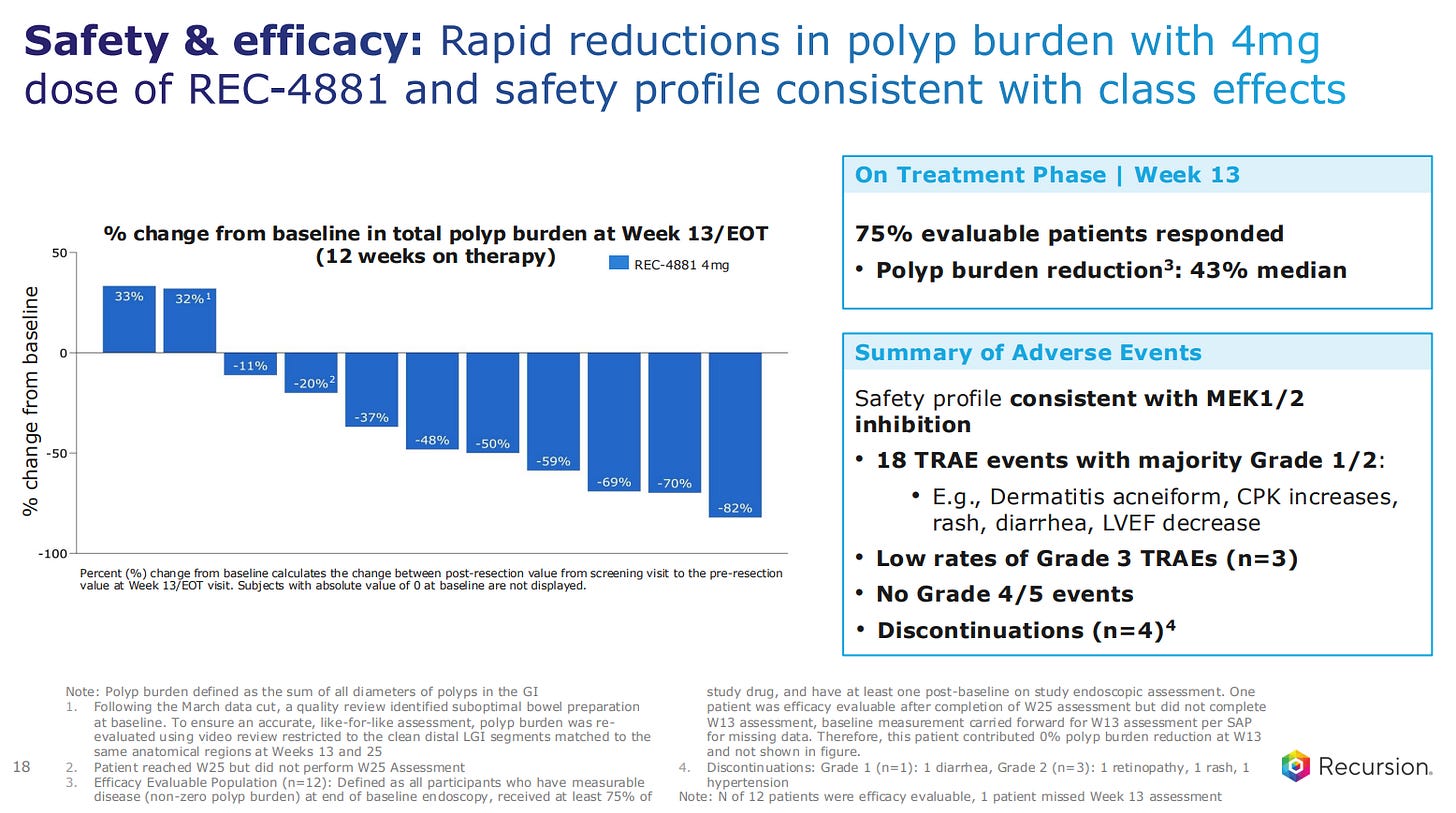

REC-4881 is the first clinical proof-of-concept for the Recursion platform, or the second wave of drug discovery. The drug provides meaningful and durable polyp reduction with a safety profile consistent with the drugs in its class.

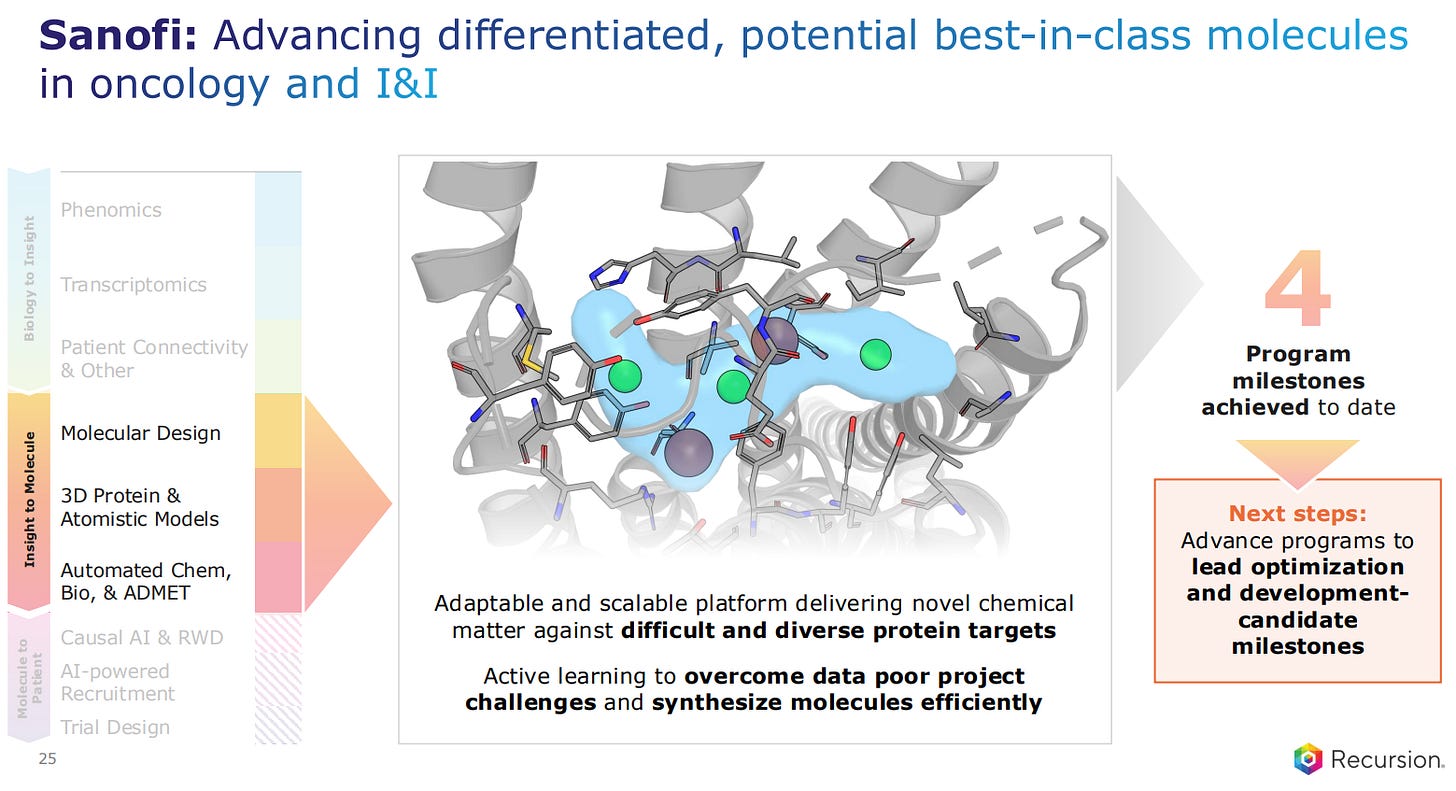

Companies like Sanofi, Roche and Genentech are validating the Recursion platform. Sanofi has several ongoing projects for AI-designed molecules with Recursion, some of which have achieved 4 milestones.

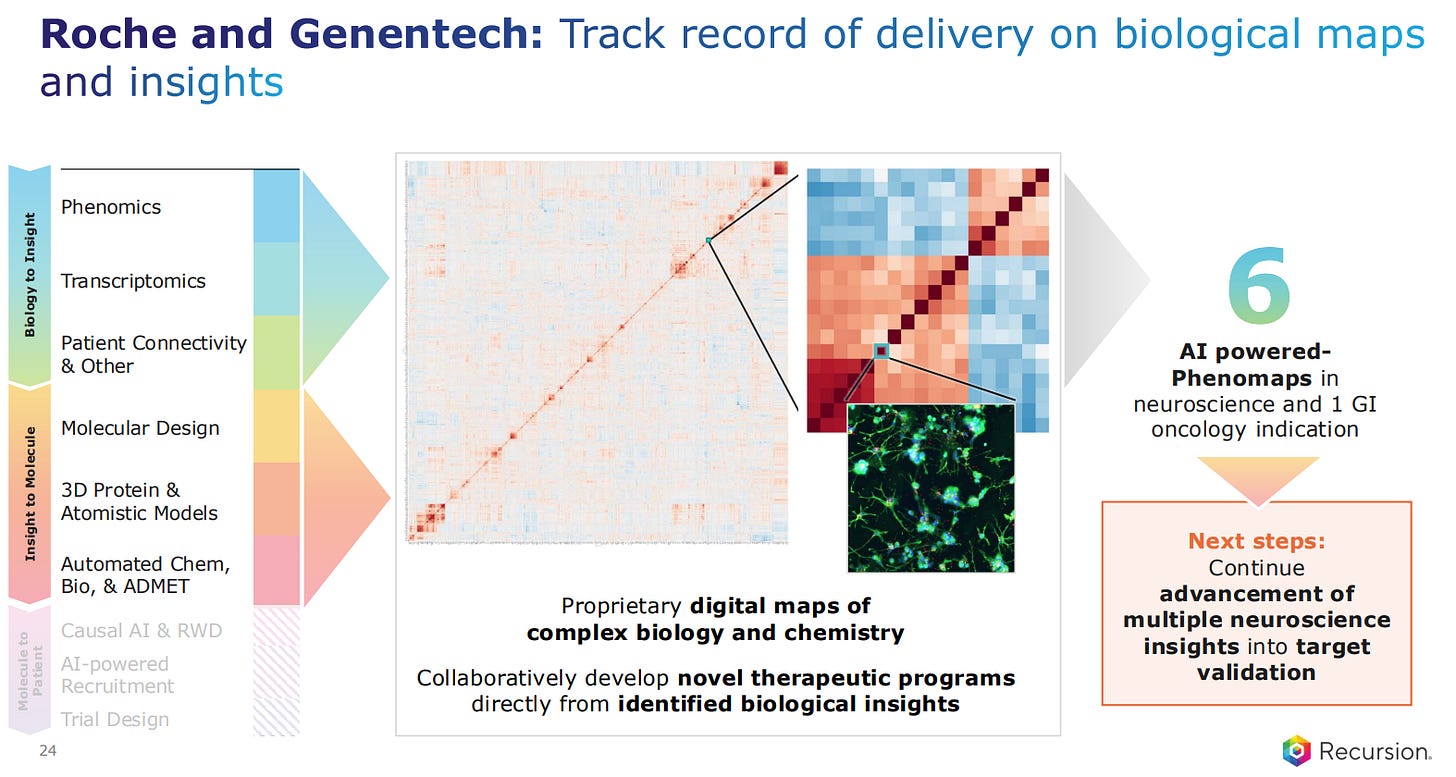

Roche and Genentech have 6 AI-powered projects, which deliver biology maps that can be interrogated for new target identification and new indications.

The next steps for REC-4881 are to optimize the dose and undergo an FDA-aligned registrational study plan. Beyond the first molecule, there are another 5 programs entering or already in clinical trials.

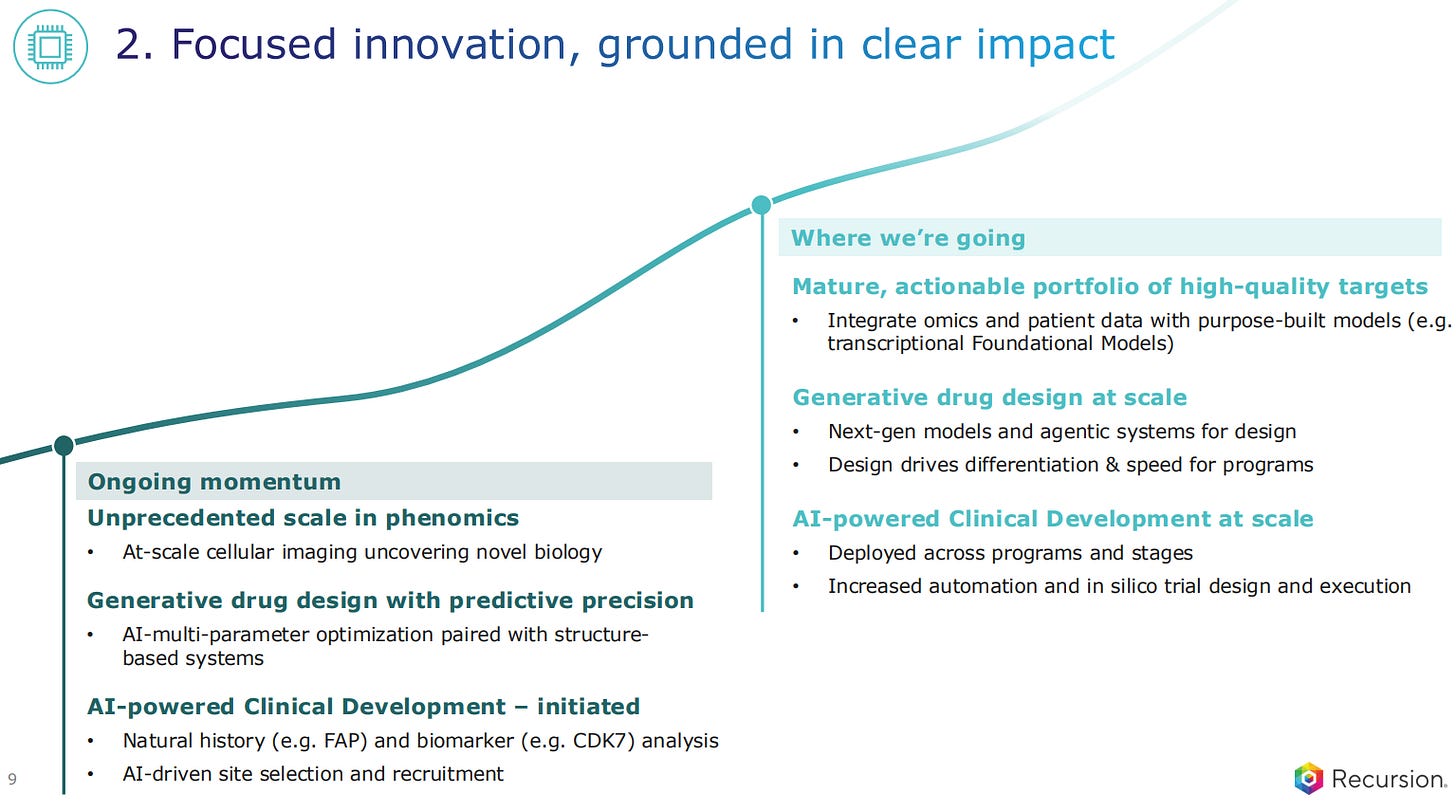

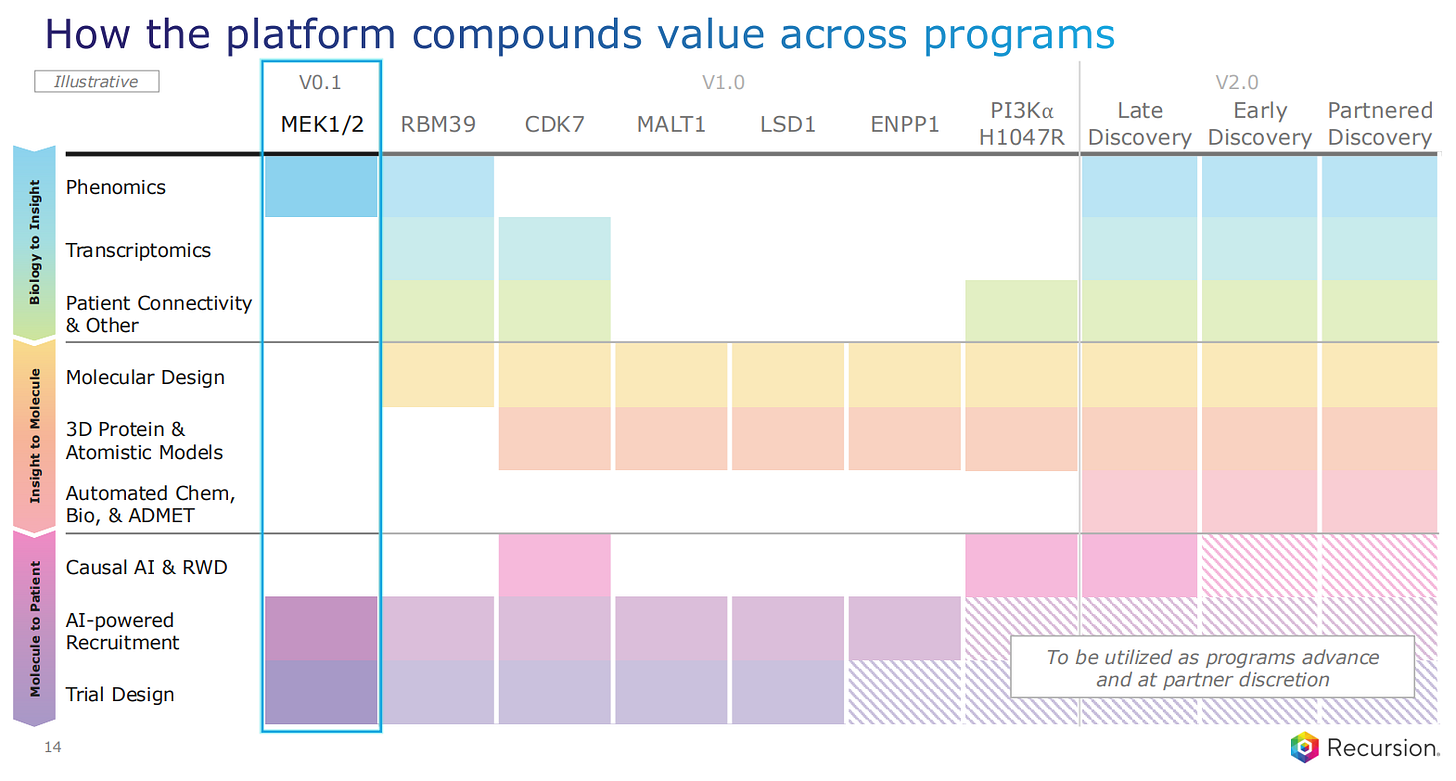

Recursion used to call their main methodology phenomics: the large-scale study of how cells look and behave when something changes, such as when a gene is altered or a drug is added. Using high-throughput cellular imaging, they would take millions of pictures of cells and use AI to detect subtle patterns in cell shape, structure, and activity.

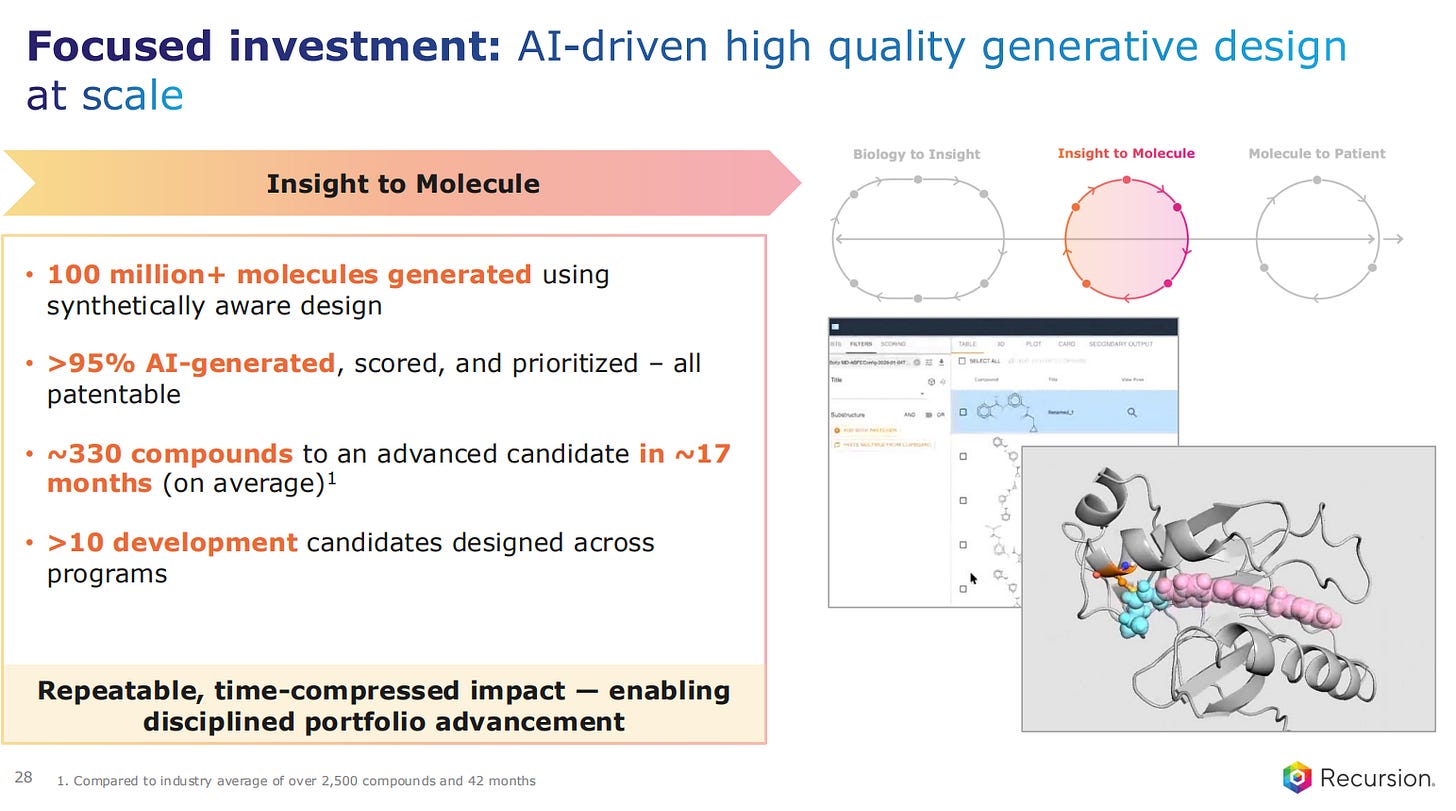

They are now also including AI-multi-parameter optimization paired with structure-based systems for generative drug design of the small molecules that come out of the system. Recent advancements in AI models now make it more feasible to design small molecules in-silico that will bind the pockets of the proteins targetted in a drug discovery campaign.

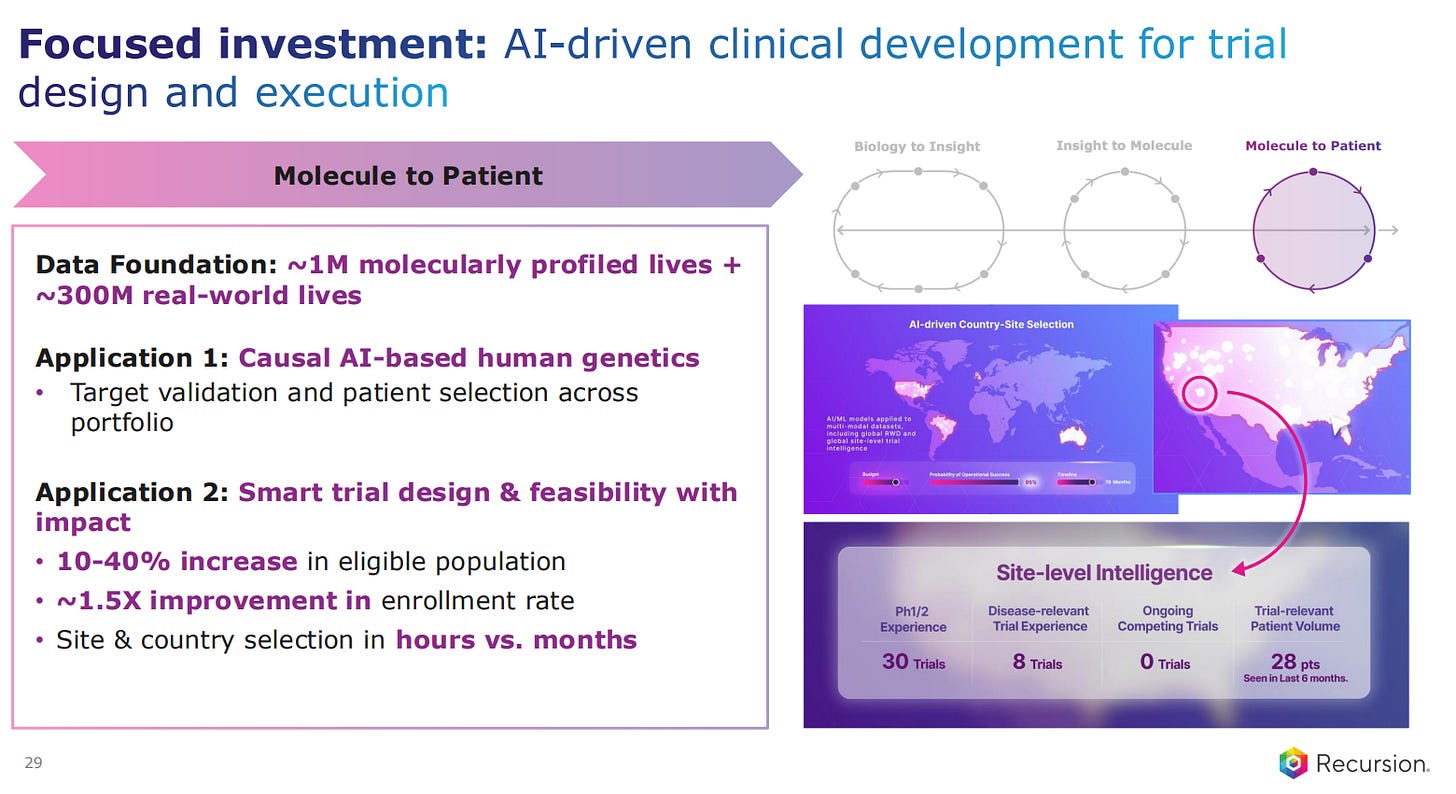

The AI-powered discovery also involves clinical development, to better understand the biology, for biomarker analysis and even to identify the best sites and recruitment into trials.

The trend moving forward for Recursion is to integrate omics and patient data with purpose-built models such as transcriptional Foundational Models of the like we’ve seen mentioned in the 10X Genomics JPM26 presentation (see full blog post here).

The generative drug design is now going to grow at scale, with next-gen models and agentic systems for the in-silico design of the small molecules.

Finally, the AI-powered Clinical Development is also scaling up, being deployed across programs and stages. In silico trial design and execution becomes the norm.

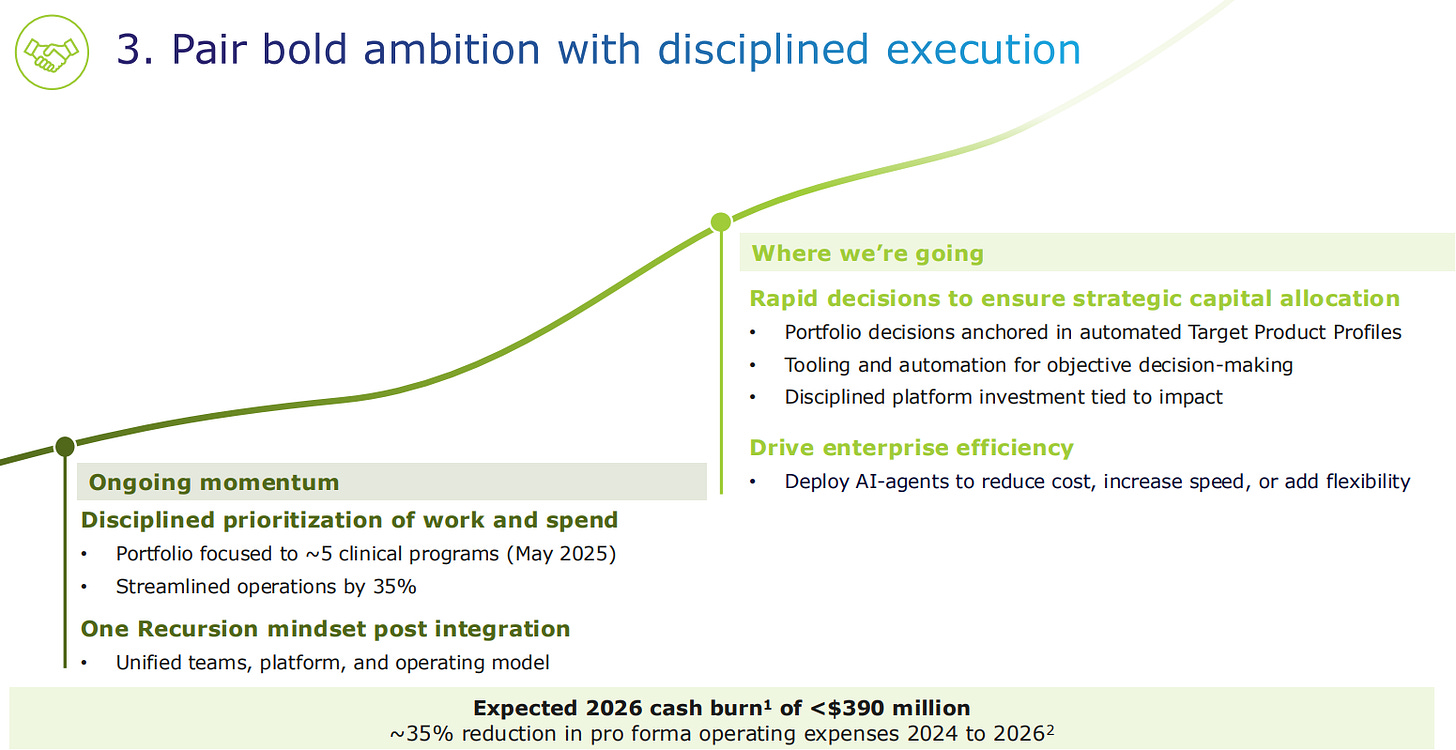

In terms of cash burn, Recursion underwent a Reduction In Force a while ago, which helped in the streamlining of operations by 35%. The company is now focusing on 5 clinical programs. They are running unified teams, platform, and operating model after the acquisition of Exscientia in London.

The expected cash burn in 2026 will be below 390 million dollars, which is a 35% reduction compared to the previous two years.

The trend moving forward is to prioritize portfolio decisions based in the automated Target Product Profile analysis. Also, tooling and automation should be driven by objective decision-making. They want to have a disciplined platform investment strategy that is tied to impact.

One way to become more efficient is to use AI-agents to reduce cost, increase speed, or add flexibility.

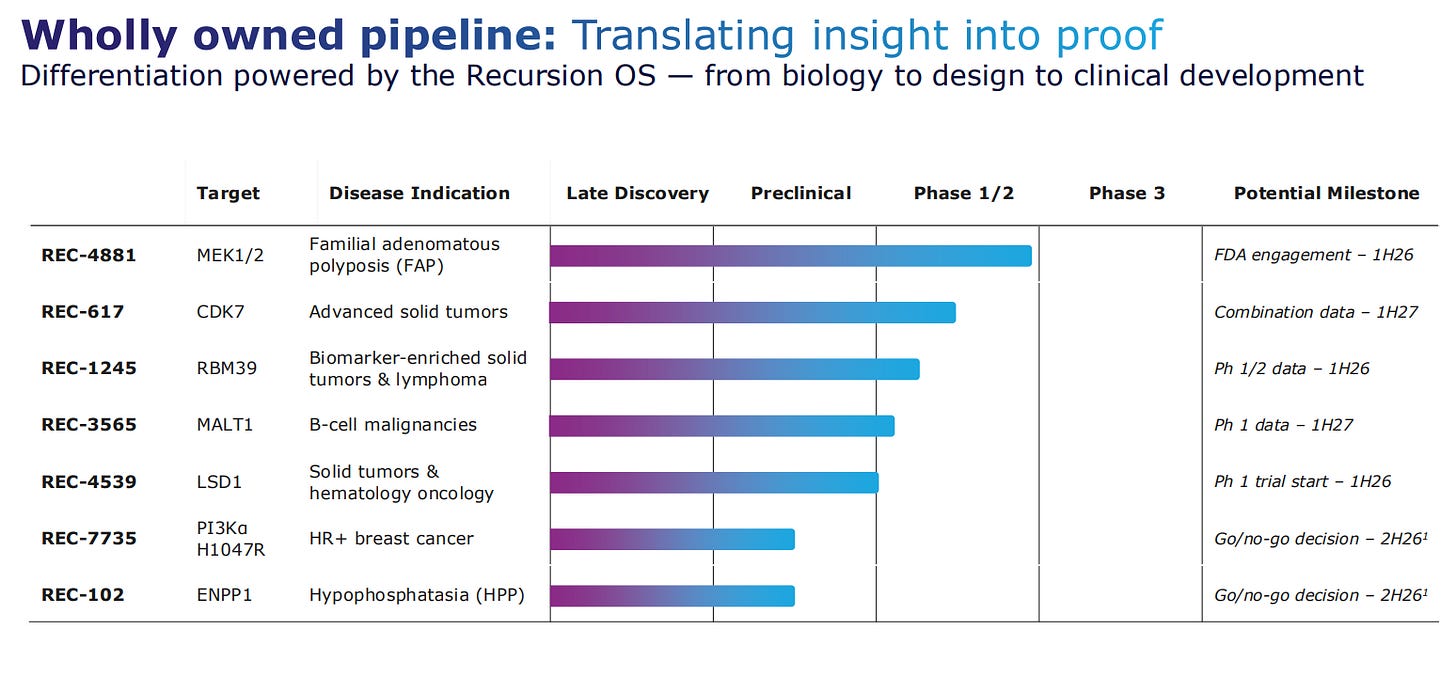

Going to asset by asset analysis, REC-4881 is the most advanced one, with FDA engagement expected in the first half of 2026. REC-617 is a CDK7 inhibitor for advanced solid tumors, expecting to have data in the first half od 2027. After that there are 3 more assets for oncology, all in the Phase 1 for 2026. Finally, the last two assets will have a go/no-go decision made in the second half of 2026.

In terms of the evolution of the technologies used, Phenomics was the first starting technology, but Transcriptomics came in line for most of the version 1 programs. The version 2 platform is used for more recent programs, and includes Molecular Design, 3D Protein and Atomistic Models, Automated Chemistry, Biology and ADMET predictions. ADMET modeling predicts how a drug will be absorbed, distributed, broken down (or metabolized), and whether it might be toxic, allowing better drug candidates to be identified earlier.

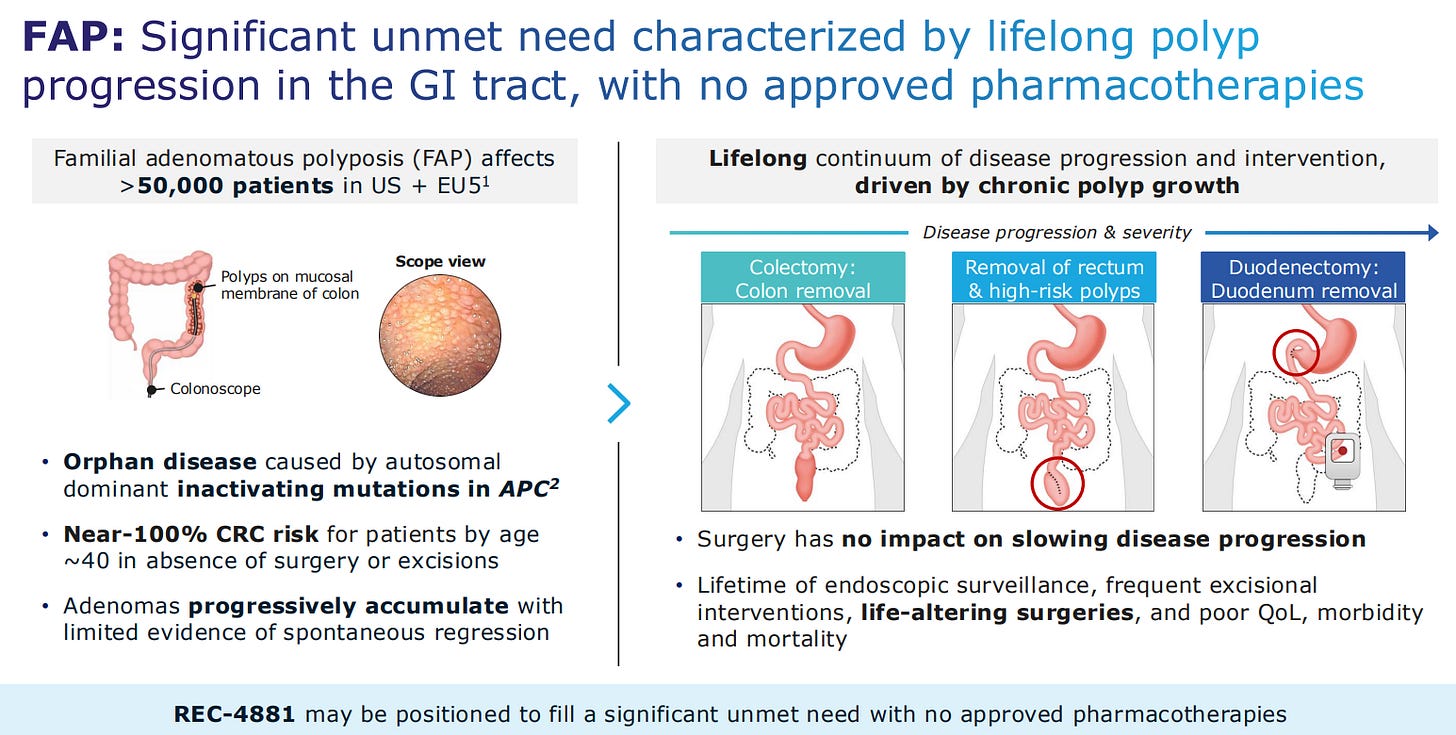

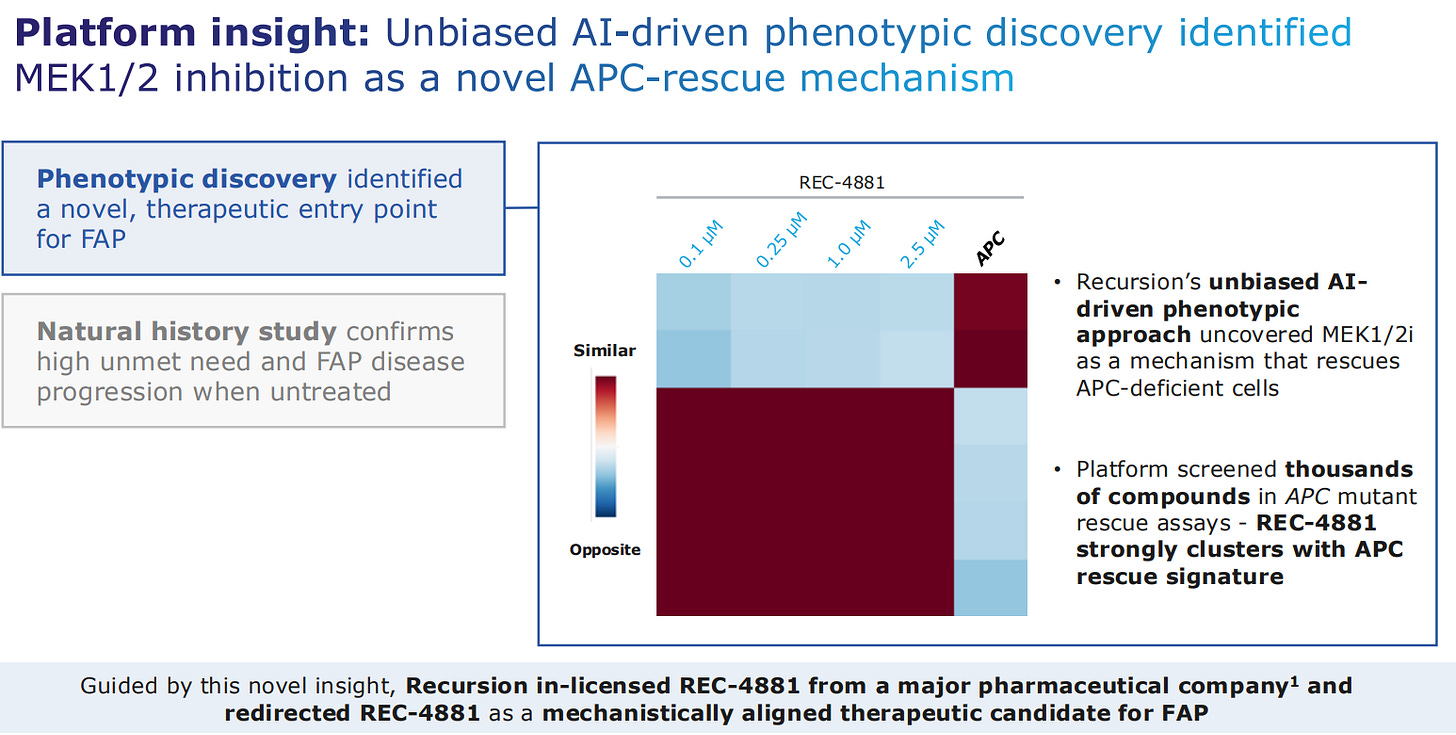

Going back to the most advanced asset, this is for familial adenomatous polyposis, also known as FAP. This is considered an orphan disease caused by inactivating mutations in the gene APC.

The drug here was designed to intervene in the MEK1/2 pathway, detecting that the drug would rescue APC-deficient cells, depicted with the heatmap where dark red means the function is recovered.

The actual small molecule was already in a pharma companies portfolio, and Recursion in-licensed it for this new indication that Recursion had discovered.

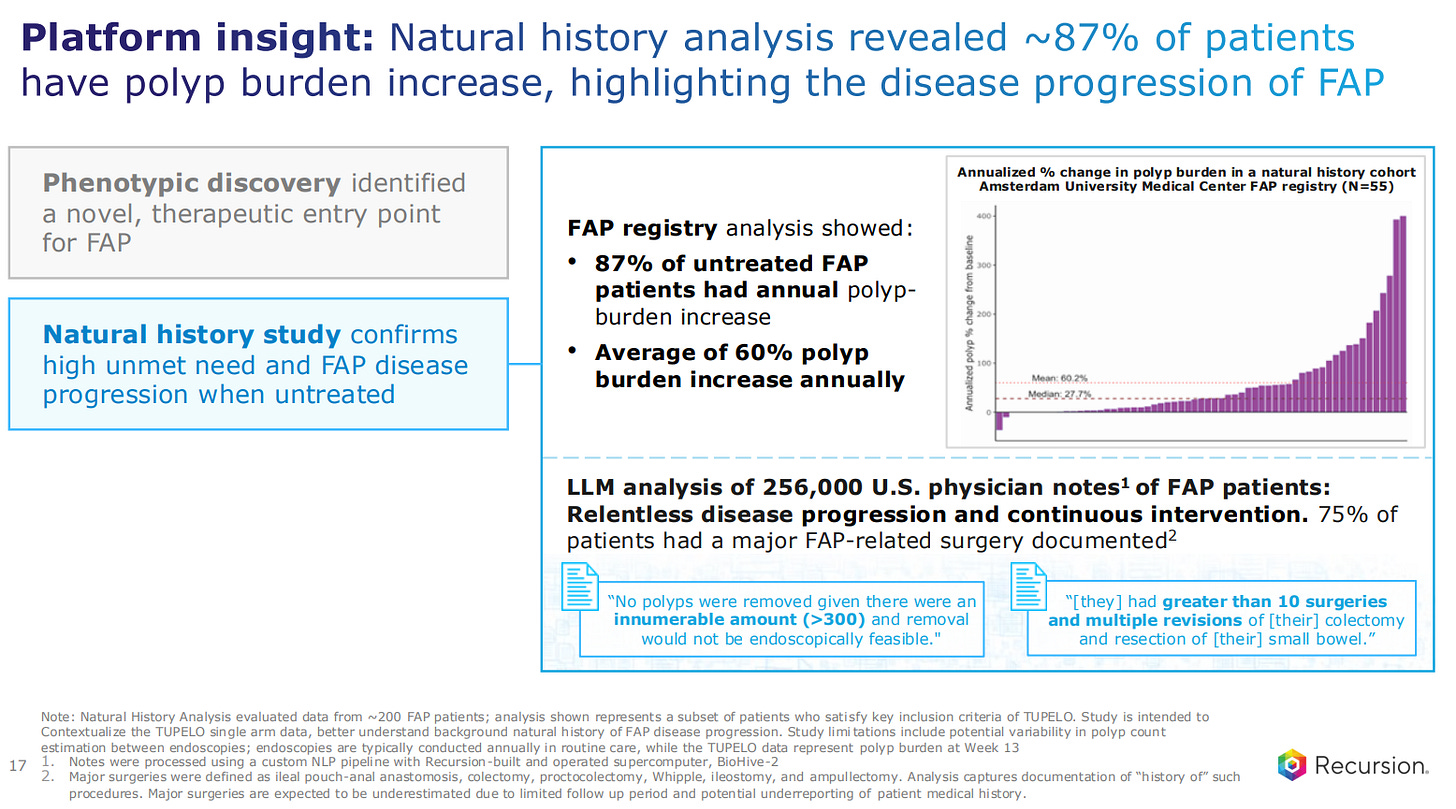

An LLM analysis of 256,000 US physician notes uncovered the relentless disease progression and continuous intervention which solidifies the case for a drug for this disease.

The safety profile of the drug is consistent to what is expected for a drug inhibiting the MEK1/2 pathway. There were no grade 4 or 5 events during the trials, and only 4 discontinuations, one of them a grade 1 case of diarrhea.

Moving on to the partnered drug discovery programs, here Recursion is making use of their Operation System to discovery drugs for other pharma companies. The ‘Biology to Insight’ step involves a combination of Phenomics, Transcriptomics and Patient Connectivity and other analyses. Then these leads are taken to the Precision Design part of the pipeline, where the lead drugs are analysed through the study of causality and Real World Data, the recruitment process and the Trial Design.

The companies pay milestones for the different steps, with Sanofi having already paid a total of $26 million so far, and Roche and Genentech a total of $30 million in the last two years.

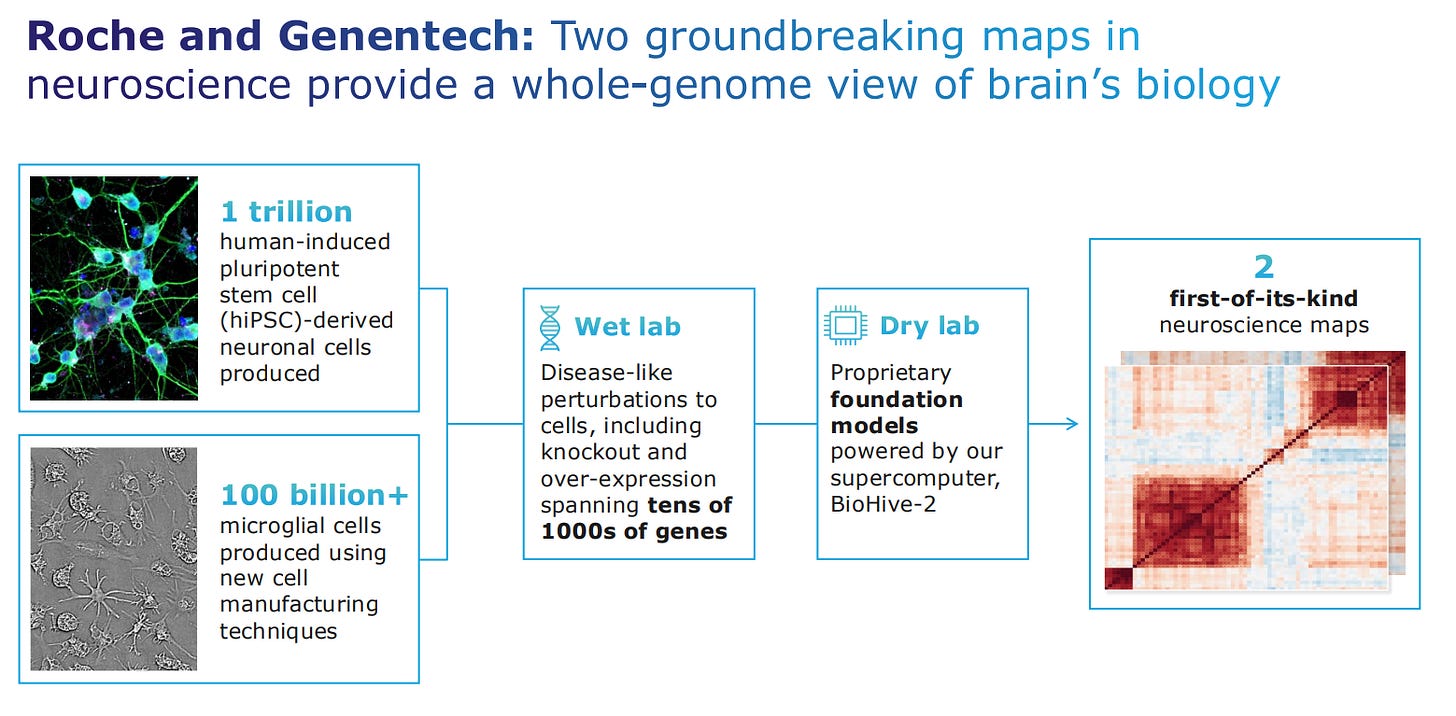

The Roche and Genentech partnership is an example of biological maps interrogation in the area of neuroscience, to come up with the first heatmaps for neuroscience that uncover new targets and indications.

These Phenomaps will now advance into target validation of multiple neuroscience and oncology indications.

Sanofi is advancing potential best-in-class molecules for both oncology and I&I. These projects will now undergo lead optimization and development-based candidate selection.

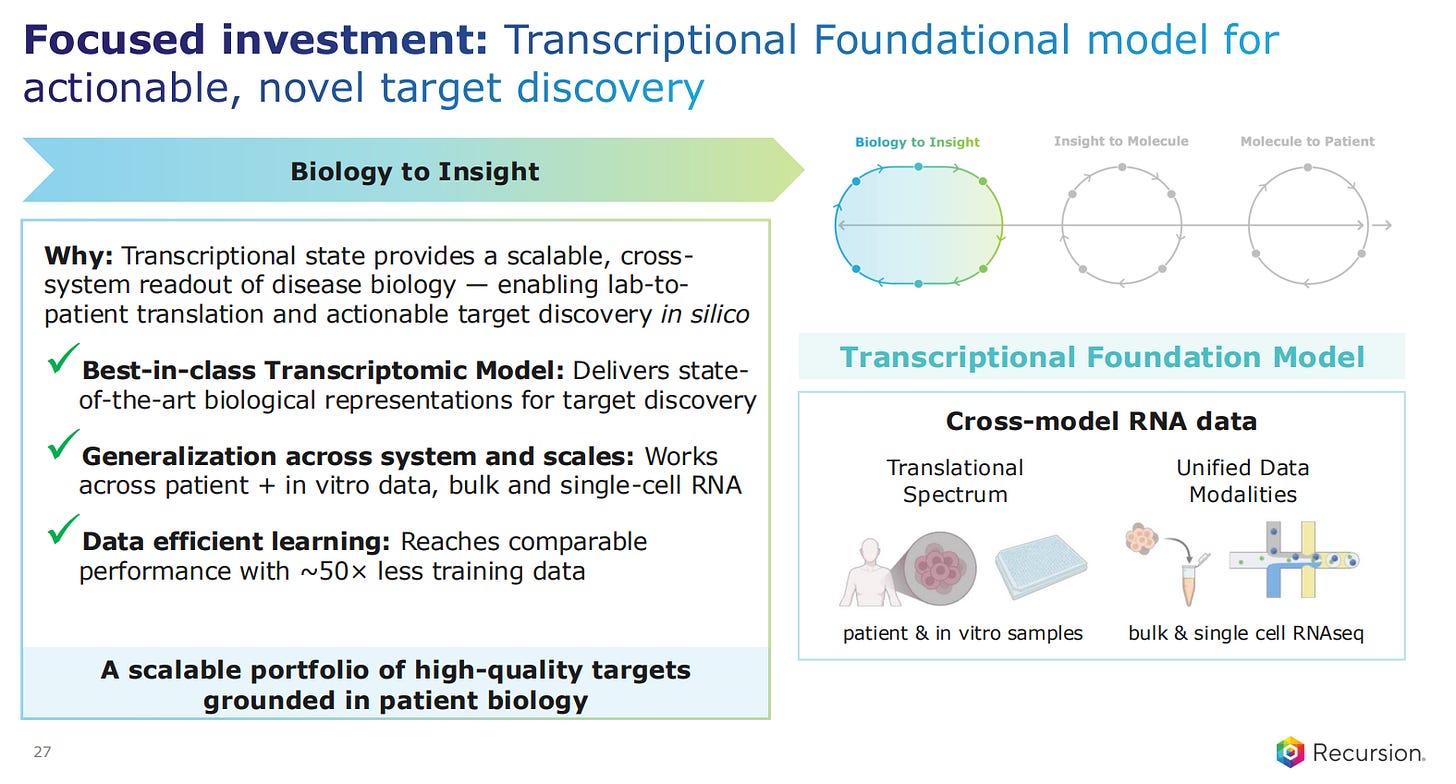

Delving deeper into the different technologies at play, Recursion explains what the Transcriptional Foundational models are, which allow for actionable and novel target discovery. These are cross-model RNA data models, that go from patient and in vitro samples and have unified data modalities, both bulk RNAseq and single-cell RNAseq.

Recursion estimates that these models can reach comparable performance to more classic target discovery models with 50 times less training data.

The in-silico design of small molecules has now taken centre stage in the ‘Insight to Molecule’ part of the pipeline. They are now producing more than 95% of the molecules with AI modelling, and they are all patentable. It takes on average 330 compounds to go into advance candidates in a process that is 17 months in total.

This is a repeatable, time-compressed process, which Recursion is applying in a disciplined manner to portfolio advancement.

The final part of the pipeline is the clinical development for trial design and execution. Recursion is applying AI-based human genetics modelling to find the causality of the targets, as well as for patient selection.

The use of AI also goes into smart trial design and feasibility analysis.

The final slide summarizes what are the expected pipeline and partnership catalysts for the next two years, with the different inflection points for the wholly owned assets, the partner catalysts of existing and new projects, all with a combination of bold ambition and disciplined execution.

Strategic Positioning

In the lines below, I will give my personal take on the Recursion presentation, what it means for where the company stands today in terms of company value and their stock price, and what possible M&A moves we might see in the future.